- 30 Largest Banks

By Andrew Pierce

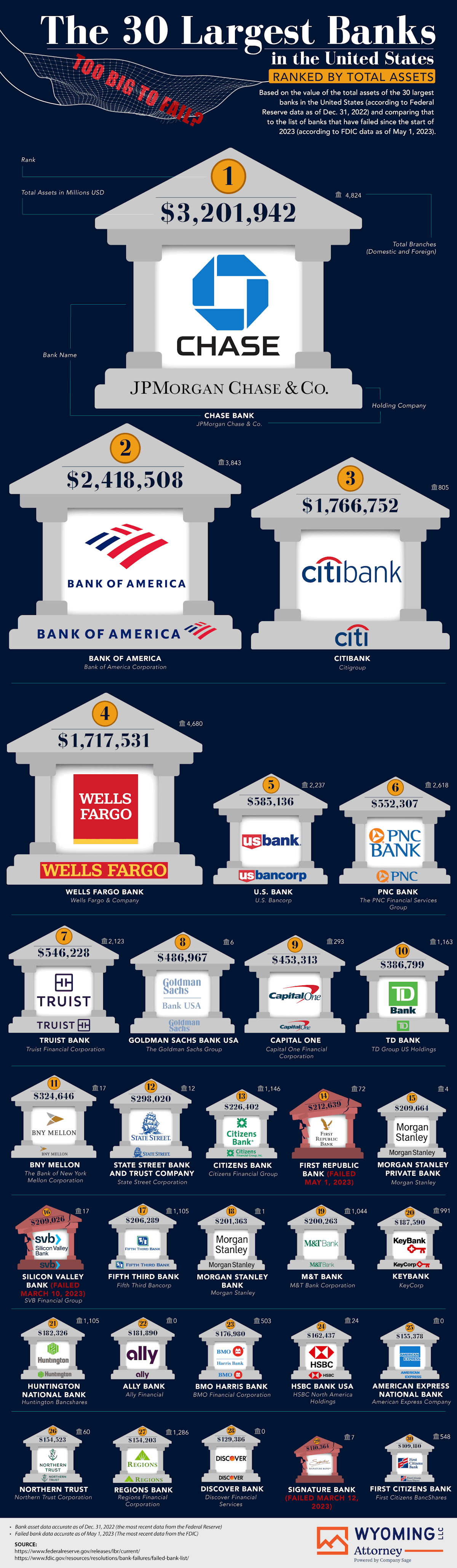

Too Big to Fail? The 30 Largest Banks Ranked by Total Assets

In terms of finance, assets are anything that a bank owns and can include cash in checking or savings accounts, securities, and loans that generate interest like mortgages and personal loans. The largest and best banks in America have trillions of dollars in assets. While some of the biggest banks in the world are located in China, the United States is home to many large banks.

The team at Wyoming LLC Attorney looked at data from the Federal Reserve to visualize the 30 largest banks in the United States based on the value to total assets at the end of 2022 – including major banks that have since failed according to the Federal Deposit Insurance Corporation (FDIC). See what banks are on the list.

Click the image to expand

Failed Bank Update: On May 1, 2023, First Republic Bank permanently closed and all of its assets were seized and auctioned off by the FDIC. JPMorgan Chase won the auction and purchased the majority of First Republic Bank’s assets for $10.6 billion.

What Are the Largest Banks in the U.S.?

According to the Federal Reserve, Chase Bank is the biggest bank in the United States in terms of assets. As of December 31, 2022, the financial institution has $3,201,942,000,000 in assets. The bank has nearly 5,000 branches around the world in more 100 countries. Chase’s holding company is JPMorgan Chase & Co., which is a multinational financial services company headquartered in New York City. One of its predecessors is the Bank of the Manhattan Company, which was founded in 1799.

The second bank on the list is Bank of America, with $2,418,508,000,000 in assets. Bank of America, which has its headquarters in Charlotte, NC, it was founded in 1998 with the merger of BankAmerica and NationsBank. Bank of America has nearly 4,000 locations in more than 40 countries. In addition to being the second-largest bank in the United States, it is also the second-largest bank in the world by market capitalization.

Citibank is the third-largest bank in America, with $1,766,752,000,000 in assets. It was originally founded in 1812 as the City Bank of New York. Their headquarters is located in New York City. Citibank offers a number of financial services including standard banking services, mortgages, personal loans, commercial banking, and more.

Coming in fourth is Wells Fargo Bank. This institution has $1,717,531,000,000 in assets as of December 2022. Headquartered in San Francisco, Well Fargo was originally founded in Minneapolis in 1929 as Northwest Bancorporation. There are more than 4,000 Wells Fargo bank locations around the world

Together, Chase, Bank of America, Citibank, and Wells Fargo make up the “Big Four” banking institutions of the United States and are some of the largest banks in the world.

Which of America’s Largest Banks of 2022 Have Already Failed?

The Federal Reserve released their latest report on large commercial banks in December 2022, but some of the top banks on the list have already failed.

Silicon Valley Bank was the 16th largest bank in the United States at the end of 2022, with more than $200 billion in assets. It was founded in 1983 with headquarters in Santa Clara, CA. In March 2023, amid high inflation around the world, there was a run on the bank, and the excessive withdrawals with insufficient liquidity led to the bank’s collapse. It is the second-largest bank failure in U.S. history.

Signature Bank, which is at the 29th spot on the list of largest banks in America, had $110 billion in assets as of December 2022. The company was founded in 2001 and had its headquarters in New York City. For most of its existence, it was focused on wealthy clients in the New York City area. Signature Bank got into the cryptocurrency industry in 2018, which made up a good percentage of its deposits. In March 2023, federal regulators expressed concern about depositors withdrawing significant amounts of money from the bank and feared a similar outcome as Silicon Valley Bank. The New York State Department of Financial Services took over the bank on March 12 and named the FDIC as the receiver.

The collapse of Signature Bank is the third-largest bank failure in U.S. history. “Too big to fail” is a theory that certain financial institutions are so large and critical that their collapse would be detrimental to the economy. When facing failure, they must be supported or bailed out by the government in order to avoid danger to the economy.

For individuals, an asset protection trust can help to protect your assets without losing control of them. Assets that can be protected include bank accounts, real estate, intellectual property, and more.

The Largest Banks in the United States Ranked by Assets

| Rank | Bank Name | Holding Company | Total Assets in Millions USD | Total Branches (Domestic and Foreign) |

|---|---|---|---|---|

| 1 | Chase Bank | JPMorgan Chase & Co. | $3,201,942 | 4,824 |

| 2 | Bank of America | Bank of America Corporation | $2,418,508 | 3,843 |

| 3 | Citibank | Citigroup | $1,766,752 | 805 |

| 4 | Wells Fargo Bank | Wells Fargo & Company | $1,717,531 | 4,680 |

| 5 | U.S. Bank | U.S. Bancorp | $585,136 | 2,237 |

| 6 | PNC Bank | The PNC Financial Services Group | $552,307 | 2,618 |

| 7 | Truist Bank | Truist Financial Corporation | $546,228 | 2,123 |

| 8 | Goldman Sachs Bank USA | The Goldman Sachs Group | $486,967 | 6 |

| 9 | Capital One | Capital One Financial Corporation | $453,313 | 293 |

| 10 | TD Bank | TD Group US Holdings | $386,799 | 1,163 |

| 11 | BNY Mellon | The Bank of New York Mellon Corporation | $324,646 | 17 |

| 12 | State Street Bank and Trust Company | State Street Corporation | $298,020 | 12 |

| 13 | Citizens Bank | Citizens Financial Group | $226,402 | 1,146 |

| 14 | First Republic Bank (failed May 1, 2023) | $212,639 | 72 | |

| 15 | Morgan Stanley Private Bank | Morgan Stanley | $209,664 | 4 |

| 16 | Silicon Valley Bank (failed March 10, 2023) | SVB Financial Group | $209,026 | 17 |

| 17 | Fifth Third Bank | Fifth Third Bancorp | $206,289 | 1,105 |

| 18 | Morgan Stanley Bank | Morgan Stanley | $201,363 | 1 |

| 19 | M&T Bank | M&T Bank Corporation | $200,263 | 1,044 |

| 20 | KeyBank | KeyCorp | $187,590 | 991 |

| 21 | Huntington National Bank | Huntington Bancshares | $182,326 | 1,105 |

| 22 | Ally Bank | Ally Financial | $181,890 | 0 |

| 23 | BMO Harris Bank | BMO Financial Corporation | $176,980 | 503 |

| 24 | HSBC Bank USA | HSBC North America Holdings | $162,437 | 24 |

| 25 | American Express National Bank | American Express Company | $155,378 | 0 |

| 26 | Northern Trust | Northern Trust Corporation | $154,523 | 60 |

| 27 | Regions Bank | Regions Financial Corporation | $154,203 | 1,286 |

| 28 | Discover Bank | Discover Financial Services | $129,386 | 0 |

| 29 | Signature Bank (failed March 12, 2023) | $110,364 | 7 | |

| 30 | First Citizens Bank | First Citizens BancShares | $109,180 | 548 |