- Holding Company Setup

By Andrew Pierce

Why a Wyoming LLC Holding Company?

Summary

The benefits of a holding company structure exceed the time and cost of implementing it. Whether your motivation is asset protection, privacy, taxes, or all three, then a Wyoming holding company may be for you. It's important to note an LLC can be a holding company, and a trust can own an LLC. Learn more about our Wyoming LLCs here and please contact us today if you have any questions.

Holding Company Definition

A holding company provides benefits which are impossible to provide via a single business entity. Holding companies are created the same way other companies are, and may be either LLCs or Corporations. Instead of engaging in operations, they merely own and control other companies and assets.

The company can engage in operations via subsidiaries or sister companies when needed. Assets may also be loaned or leased to third parties. The intent is to isolate liabilities, provide anonymity where possible and minimize taxes when feasible.

Some effort is required to set up the structure. The resulting benefits more than pay for themselves, though. While Corporations and LLCs may both be used, this page focuses on Wyoming limited liability companies because of their superior asset protection benefits.

| Service: | Wyoming LLC Holding Company Formation |

|---|---|

| Cost: | Starting at $99 + State Fees |

| Turnaround: | 24 Hours |

| We Also Offer: | Registered Agent and Business Address, Bylaws, Free Bank Account |

Who Uses Holding Companies?

- Real Estate Investors: Owning and renting real estate is inherently risky. Separating property management from the real estate can prevent catastrophic losses from slip and fall and other frivolous lawsuits. Follow our link to learn more about real estate holding companies.

- E-Commerce: Opening subsidiaries for different product lines not only isolates risk, but makes it easier to sell product lines individually.

- Families: One holding company makes it easier to manage disparate interests in other companies and assets. It also allows for the filing of a consolidated return.

- Estate Planning: Rather than the effort of an estate plan, some choose to pass assets on via an LLC. While we always recommend an estate plan, generally using a trust, we know some clients do view this as a more affordable option.

- Other Risky Industries: Any industry with risky but valuable assets. Those assets should be owned by one company and operated by another. See our examples below for more details.

LLC Holding Company Graphic

LLC Holding Company Benefits

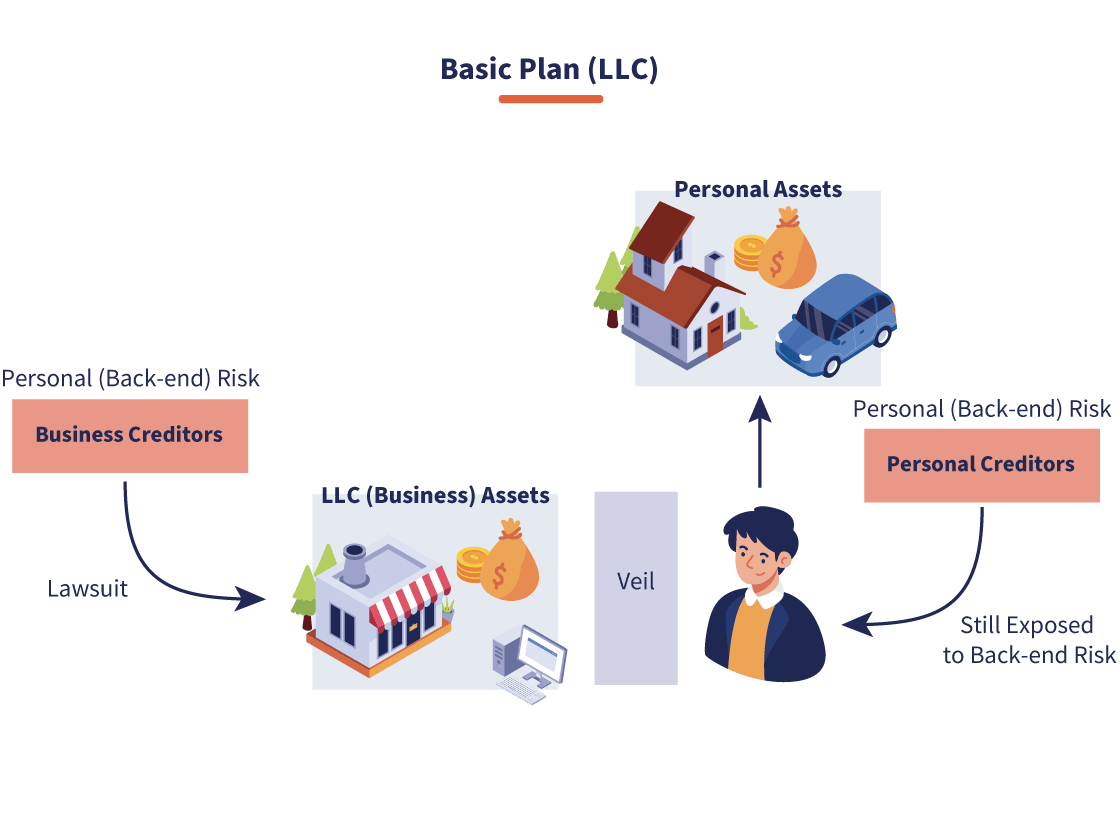

- Isolate Risk: Assets are held apart from operations to safeguard them from loss. Examples of assets which can be protected are real estate, intellectual property, cash, equipment, trademarks, patents etc.

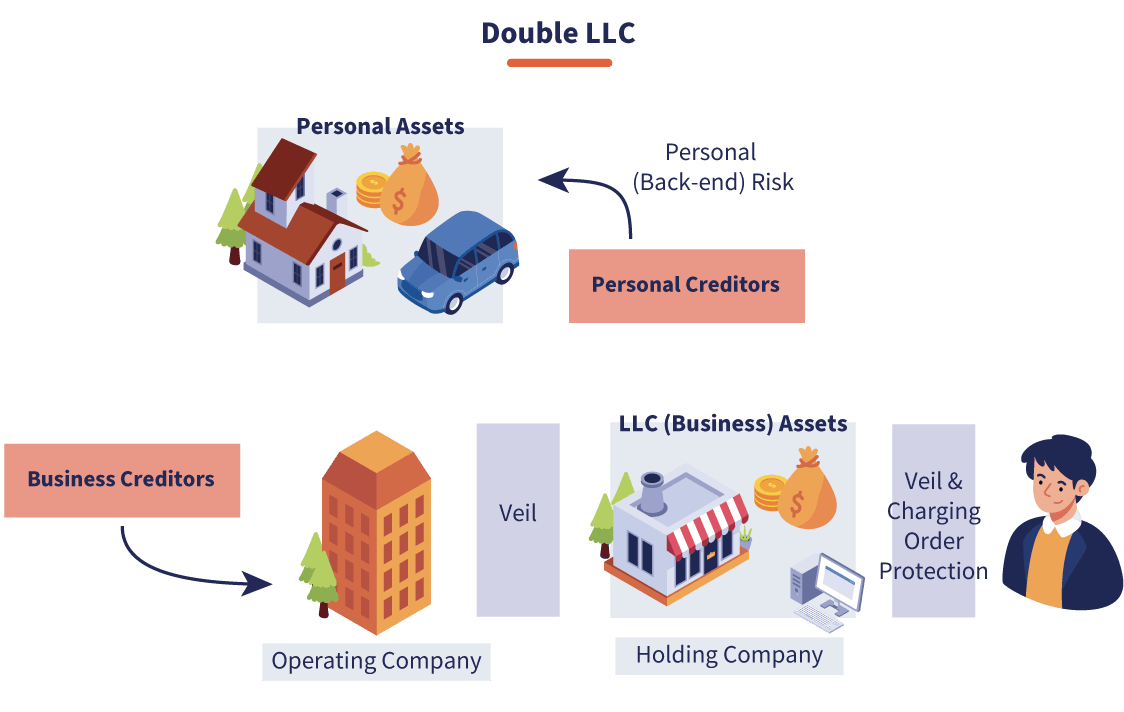

- Charging Order Protection: Wyoming LLCs are immune to personal creditors. Using a Wyoming holding company places business assets beyond the reach of personal creditors.

- Consolidated Tax Filings: Only the parent company is required to file a return, not every subsidiary.

- Anonymously Title Assets: Your anonymous LLC may be used to title assets or own other LLCs. If those ownership records are public, then the owner on record is an anonymous company.

- Minimize Taxes: Income shifted to a low or no tax jurisdiction avoids paying taxes in states with higher rates, e.g. California.

Why a Wyoming Holding Company?

Holding companies have flexibility in where they domicile. This is because simply holding assets and leasing them is not generally considered transacting business (more in the next section).

A Wyoming or Nevada LLC may thus own a Florida condo without registering as a foreign entity. The question is what state is best for your parent company? Common choices are Wyoming, Nevada, Delaware and New Mexico:

- Wyoming is the current leader. They provide specific statutes protecting single-member LLCs (subsidiaries), allow anonymity, and have a comparatively low $60 annual report.

- Nevada used to be a leader until they consistently raised fees and began reducing their anonymity by increasing disclosure requirements.

- Delaware is meant for large corporations. They are not asset protection focused and have high fees. What Bank of America needs is not what most business owners need.

- New Mexico is commonly mentioned because it allows anonymity and has no annual report. They are not an asset protection haven, however. They are thus not suited for those with valuable assets. We would recommend New Mexico if you had an online blog that you simply wanted to operate anonymously with little hassle. It is not suited for serious investors.

Every investor is different. However, the asset protection and low fees make doing business in Wyoming the frequent choice. Delaware is suitable for large corporations and New Mexico for those just needing anonymity and no asset protection. Nevada, frankly, is no longer a great choice due to their significant fees. Find a fuller comparison of WY, Nevada, New Mexico and Delaware companies here.

Operating Companies

The operating company may by necessity need to file in a state other than the one you chose above. For example, property management will require registering in the state you are managing properties. The real estate may be held in a foreign LLC, but you will need a local one for handling the property.

This does not apply to all industries. E-commerce companies may domicile all their subsidiaries in Wyoming since they are not transacting business in any other state.

Transacting Business: If you are deemed to be "transacting business" in another state, then you must register in that state. This begs the questions of what constitutes transacting or doing business?

For most states, the following are NOT considered doing business: holding meetings, owning property or real estate, opening a bank account, having a supplier or contractor, having a few clients etc.

For most states, the following are considered doing business: having an employee, renting an office or having a physical storefront, and (sometimes) property management.

Registering As a Foreign Entity

Sometimes registering is inevitable. In such cases you should run your operations via that company to the fullest extent possible while simultaneously avoiding holding assets inside of it. This isolates operational risks from valuable assets.

This operating company will lease assets as necessary to perform its function. If privacy is important, then you have a few options. In Florida, for example, you may list the owner of one company as an out-of-state entity. In this case, you would list the Wyoming company - effectively making the Florida LLC anonymous. Other states may require a name or signature. In such cases, you may use our nominee services to sign public forms. You may learn more about anonymous Wyoming LLCs and their privacy here.

Sister-Sister vs. Parent-Child Structure

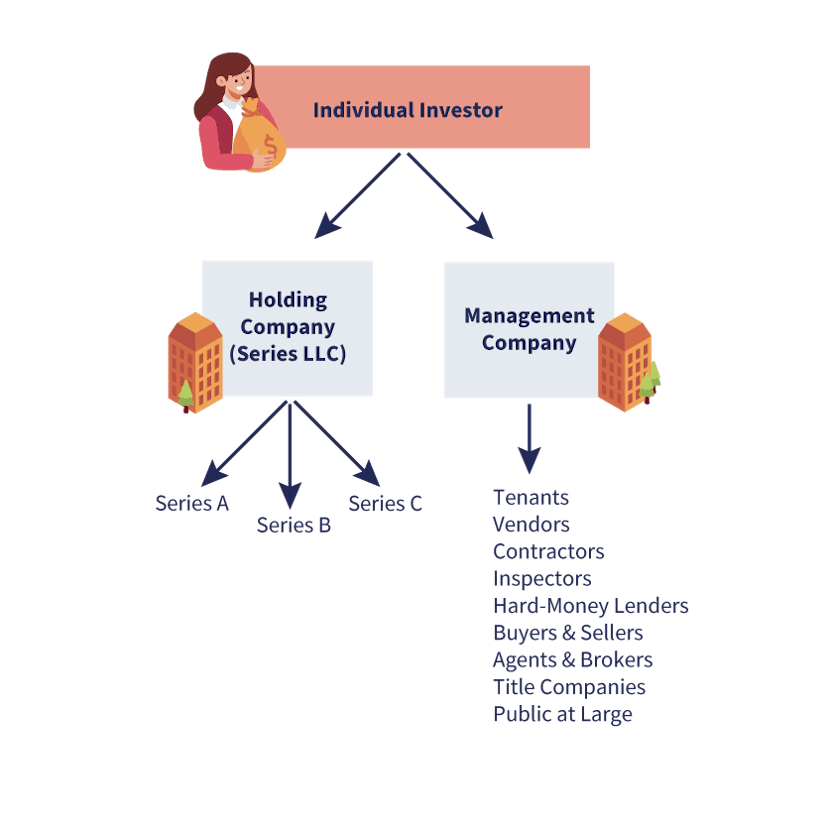

Holding structures are typically set up either with either a parent company and children, or sibling entities. To make the discussion easier, here is a graphic of a sibling set up. In this case the Holding Company holds assets via a series LLC (or traditional subsidiaries) and an operational company handles tenants, vendors, contractors, inspections, loans and the public at large:

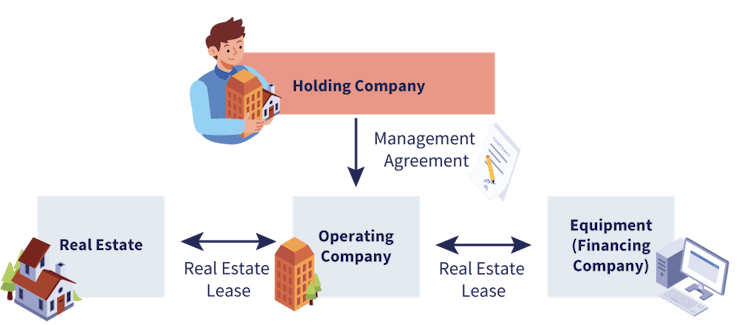

This is an image of a parent-child setup. Here a parent company oversees children companies that engage in operations. The parent company often has a management contract. Through this and other devices, income is shifted to where it is not taxed. Cash is also flowed up the parent company for safekeeping:

In other states, the sibling model can be better. This is because in the parent-child set up each subsidiary is technically a single-member LLC. If you are in a state which does not protect such companies, then you are vulnerable to creditor claims. In Wyoming, single-member limited liability companies receive all the same benefits as multi-member companies. This means you may choose whichever structure makes the most sense for your situation, neither is inherently better.

Real Estate Investment Holding Company

Real estate easily lends itself to the holding company model. There are valuable assets and operational risks. These are easily separated by owning the real estate in a separate company. Business risks aside, you may also have personal liabilities which could endanger your properties. For example a car accident.

Owning real estate in non-anonymous LLCs means the public can see what you own. This places you at increased risk of a frivolous lawsuit. Plus, if you hold all your properties in one entity, then everything is at risk in case of an accident.

The first step is to create an anonymous company. This protects you from prying eyes. The next step is a separate Limited Liability Company for managing properties. This company is in charge of maintenance and handles contracts, tenants and contractors. Those desiring additional protections should consider equity stripping or forming a Wyoming asset protection trust.

E-Commerce Holding Company

E-commerce companies favor Wyoming due to anonymity and asset protection. Different product lines can be split between entities. Clients also often form multiple entities to compete in the same space. Their competitors cannot tell, however.

Splitting up product lines is better for risk management and for spinning off successful products. Candles are inherently risky, for example, so you would not want that to risk your graphic t-shirt line. Maintaining separate accounts also makes it easier to justify valuations because your books are clean.

Wyoming Trust

An asset protection trust is a time tested method for deterring creditors. Wyoming trusts directly compete with traditional offshore havens such as the Cook Islands and Nevis. Credit protection begins immediately and there are shortened windows for contesting transfers. Trusts separate the ownership and economic benefits of an asset. The trust owns the asset, thus it cannot be taken from you. While you do not own the assets you may still benefit from them. Learn more here about Wyoming's asset protection trust.

Final Thoughts on Forming a Wyoming Holding Company

In conclusion, forming a Wyoming holding company offers numerous benefits, including asset protection, privacy, and potential tax advantages. Whether you're a real estate investor, an e-commerce entrepreneur, part of a family seeking consolidated management, or engaged in estate planning, a Wyoming holding company could be a strategic choice.

It's important to remember that an LLC can serve as a holding company, and trusts can own LLCs, providing flexibility in your financial strategy. If you have any questions or need assistance with structuring your holding company, please don't hesitate to contact us at +1 (307) 683-0983 or through our contact form. Our experienced Business Success Advisor team is here to guide you through the process and address any inquiries you may have.

Frequently Asked Questions About Holding Companies

A Wyoming holding company is an LLC or Corporation which has been formed in Wyoming and is meant to hold a variety of assets from others companies to bonds and real estate.

The best state for an individual to establish a holding company is Wyoming, and the best state for a Fortune 500 company is Delaware. We can help create a company in either.

A holding company helps separate assets and liabilities, while minimizing taxes, enhancing privacy and providing investment flexibility.

Wyoming LLCs are popular for small and family businesses because of their simplicity, anonymity, asset protection and low fees. These benefits stand in stark contrast to the 'mythical' Delaware company that in truth is good for very few.