By Andrew Pierce

Wyoming Asset Protection Trust

Anonymous Creditor Protection

Why Establish an Asset Protection Trust?

If you insure your home, car, and health, then why not insure your assets? You may set up an Asset Protection Trust for yourself, your family, or a charity. Your Trust can be used to protect assets, anonymously title property, or as part of a larger estate plan.

A Wyoming Asset Protection Trust allows you to protect assets without losing control, naming third-party beneficiaries, or moving assets to an Offshore Trust. This protects you from lawsuits, creditors, divorces, the government, and plain bad luck.

Wyoming Trust law offers flexibility, accommodating a range of Trust structures. Covered below are some variations and potential applications, such as Self-Settled, Dynasty, Perpetual, and Medicaid Trusts, among others. Wyoming imposes no residency requirements, and physical presence in the state is not necessary.

Wyoming Trust Benefits

There are several significant benefits to a Wyoming DAPT used in conjunction with a Wyoming LLC:

- Asset Protection: Assets in the DAPT cannot be reached by your creditors after the expiration of certain statutory periods, typically two years.

- Lowers Umbrella Policy Expenditures: The DAPT holds significant assets spun off from your businesses, which provides protection from major claims and lawsuits and makes an insurance policy for these assets unnecessary.

- Principal and Interest Allocation: The DAPT is governed by the Wyoming Principal and Income Allocation Act, which allows under IRC 643 certain sums of money that would otherwise be classified as income to be allocated to the maintenance of principal. This has the potential to lower your tax expenses by approximately 30%.

- Earned vs. Unearned income: Flowing certain income through the DAPT would alleviate the reporting of that income as self-earned wages and reduce the amounts paid under FICA, FUTA, and SUTA.

The combined effects of these strategies could lower your tax liabilities, including payroll taxes, by approximately 70% or more.

Which Assets Can Be Protected?

Assets that can be protected include but are not limited to:

- Personal Residence or Home

- Rental Properties & Real Estate Investments

- Investment Accounts, e.g. Brokerage Accounts

- Intellectual Property, e.g. Patents & Trademarks

- Bank Accounts, e.g. Checking & Savings

- Holding Companies & Subsidiaries

- Bitcoin, Ethereum & Other Alternative Currencies

- Limited Liability Companies

- Corporations

- Property, Plant & Equipment

- & More

Is An Asset Protection Trust Right For You?

Qualify for your consultation

What is your approximate net worth?

This helps us understand your asset protection needs.

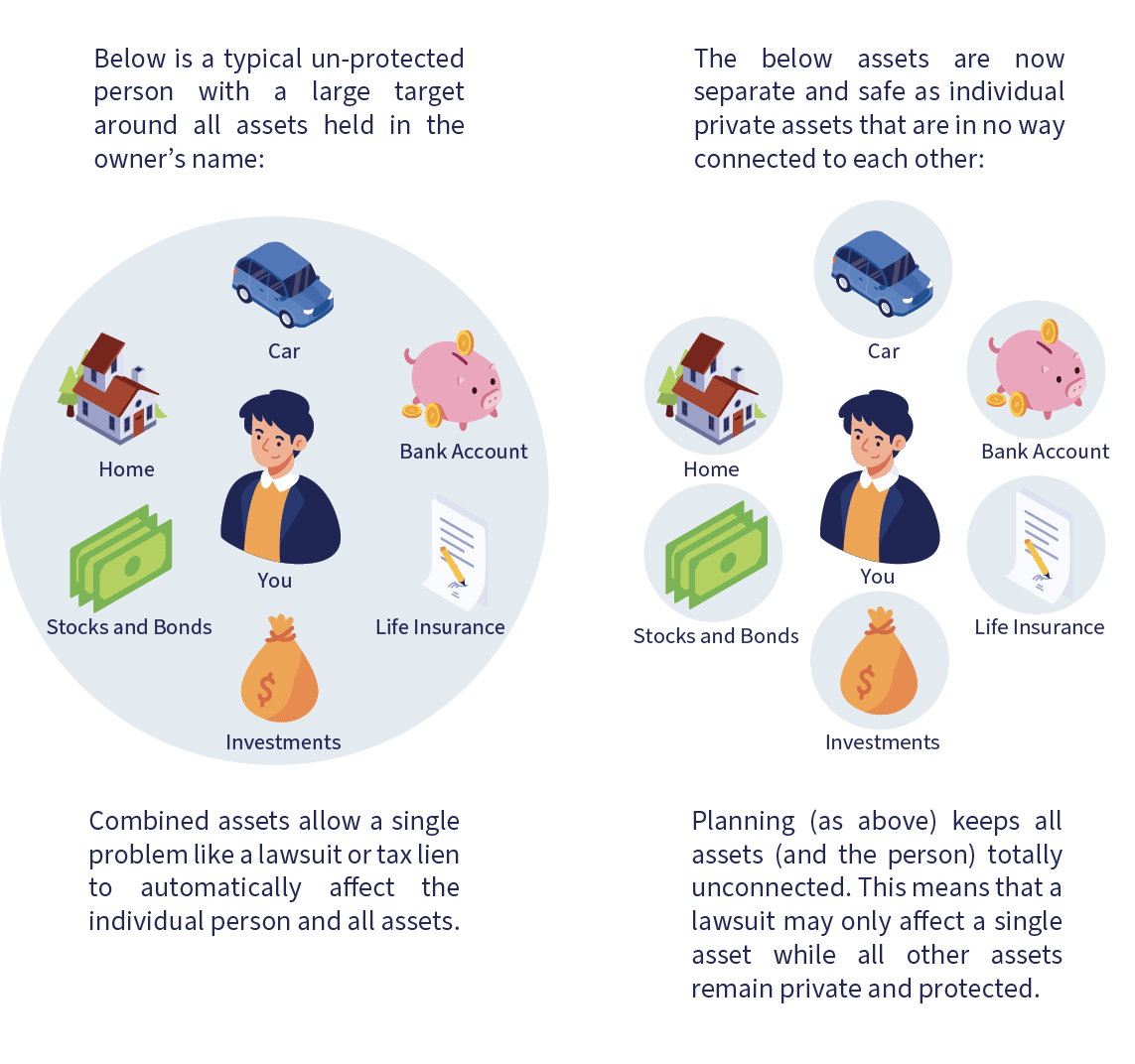

Graphic Showing How Separating Assets Works

What Is a Trust?

A Trust is an entity similar to a corporation, limited liability company, or non-profit. It is a contractual agreement drafted by an attorney who is not registered with the government. This is how it remains anonymous.

It is similar to a safe that holds assets. The Trust and its assets are managed by a trustee. The trustee may be a Public Trust Company or a Private Trust Company (controlled by you). You and the attorney will discuss which is best for you. Every Trust is comprised of three parts:

1) The Settlor: This is the person who creates the Trust and transfers their assets.

2) The Beneficiary: This is the person who "benefits" from the Trust. The assets are to be used for this person's benefit only. For a Self-Settled Trust, the settlor is the beneficiary.

3) The Trustee: This is the person or institution in charge of ensuring the Trust is properly managed. For most intents and purposes the trustee may be viewed as the manager.

After the transfer, the Trust owns the assets. You may be a beneficiary who also controls the Trust via the Private Trust Company. At this point, Trust assets cannot be used to satisfy creditor claims.

Wyoming Trust Law

The legislature here has worked hard to create an asset protection and tax haven. Wyoming Trust law benefits are not loopholes. The statutes are meant to be taken advantage of.

- Anonymous

- Self-Settled, Qualified Spendthrift & Discretionary Trusts are allowed

- Credit Protection Begins Immediately - No Waiting Period

- No Income, Gift, Estate, Excise, or Intangible Taxes

- Multi-Generational, Perpetual & Dynasty Trusts

- No Minimum Capital Investment

- Trust Protector & Decanting Statutes

- Maintenance is Half a Nevada Trust or Delaware Trust

- Regulated & Unregulated Trust Companies Are Allowed

There are many forms a Wyoming Asset Protection Trust can take. You can create a Trust to provide during your lifetime while providing for your family afterward. They may be used for minimizing taxes, owning assets anonymously, protecting assets, and more.

How to Use a Trust

It would be a mistake to dismiss Trusts as simply a subset of estate planning. Instead, Trusts are sophisticated agreements providing a wide variety of benefits and uses. Below are just a few situations where forming a Trust is beneficial:

1) Protect your personal residence and bank account from liabilities such as car accidents or other events personal injury attorneys love.

2) Doctors, attorneys, and other professionals may shelter assets to avoid high malpractice and other insurance premiums. If your home, savings account, and other assets are protected, then claimants have nothing to pursue.

3) Own a holding company and subsidiaries. This is common with real estate investors and companies with significant intellectual property. Find our Wyoming LLC formation service here.

4) It may be used as an alternative to a Prenuptial Agreement. Assets in an Irrevocable Trust are outside the marital estate. This places them beyond the divorce court's reach.

5) Avoid SALT Cap limits under the new tax law by using Non-Grantor Trusts.

Above are only a few potential applications of Wyoming's Asset Protection Trust. There are as many applications as there are people and their situations.

What Is a Self-Settled Trust?

Put simply, a Self-Settled Trust is a Trust you form for your own benefit. It is anonymous and provides immediate credit protection. Other states require you to establish Trust for someone else, i.e. a third-party Trust. This limitation previously drove Offshore Trust formations. Domestic Asset Protection Trusts now have the same benefits as Trusts overseas without complications.

The uses of such entities are varied. A Trust formed prior to marriage is considered outside your marital estate. The assets are immune to divorce and make a prenuptial agreement unnecessary. A Self-Settled Trust can also be the foundation of an estate plan either now or later on.

Wyoming's Dynasty Trust

A Wyoming Dynasty Trust is a long-term Trust designed to efficiently transfer wealth from generation to generation. It avoids transfer taxes such as estate tax, gift tax, and the generation skipping tax (GST).

Beyond tax benefits, the Dynasty Trust also protects assets from a future generation's creditors. For example, teenage automobile accidents or divorces. These are called unintended beneficiaries. They are called unintended because when you set everything up your intent was not to pay for an automobile accident or for half the funds to go to your child's ex-spouse. With proper planning, you can "lock out" unintended beneficiaries.

Some think because current estate tax exemptions are high they do not need to worry about estate taxes. This is false complacency. The limit has ranged from $1,000,000 to $21,000,000 over the previous 30 years. Where it will be when you pass away is anyone's guess. That is why it is smart to plan for an unexpected lowering of the estate tax exemption even if it is not immediately needed.

What Is a Purpose Trust?

This entity does not have a beneficiary. It instead exists to further a non-charitable purpose or cause. Examples are the maintenance of a property or a pet. While such formulations may seem odd they are enforceable by law. Note, that a Trust established for charity is in truth a Purpose Trust but is instead referred to as a charitable Trust.

What Is a Statutory Trust?

Statutory Trusts are filed with the Wyoming Secretary of State. They are commonly used for REITs (Real Estate Investment Trusts) and similar strategies. They are allowed in most states. Wyoming is unique, though, because the trustee may be an anonymous Wyoming limited liability company. A Wyoming Statutory Trust offering investments such as securities is overseen by the SEC (Securities and Exchange Commission).

Grantor vs Non-Grantor Trusts

Whether a Trust is a Grantor or Non-Grantor Trust is a question of how the Trust's income is taxed. If the income passes through to the beneficiaries, then it is a Grantor Trust. If the Trust pays its own income taxes, then it is a Non-Grantor Trust.

This distinction has become more popular as this year's SALT Deduction limits come into place. This has driven many to establish Non-Grantor Trusts for their real estate investments. Each Trust qualifies for its own $10,000 deduction. Learn more about Irrevocable Income Only Trusts (IIOT) and their taxes here.

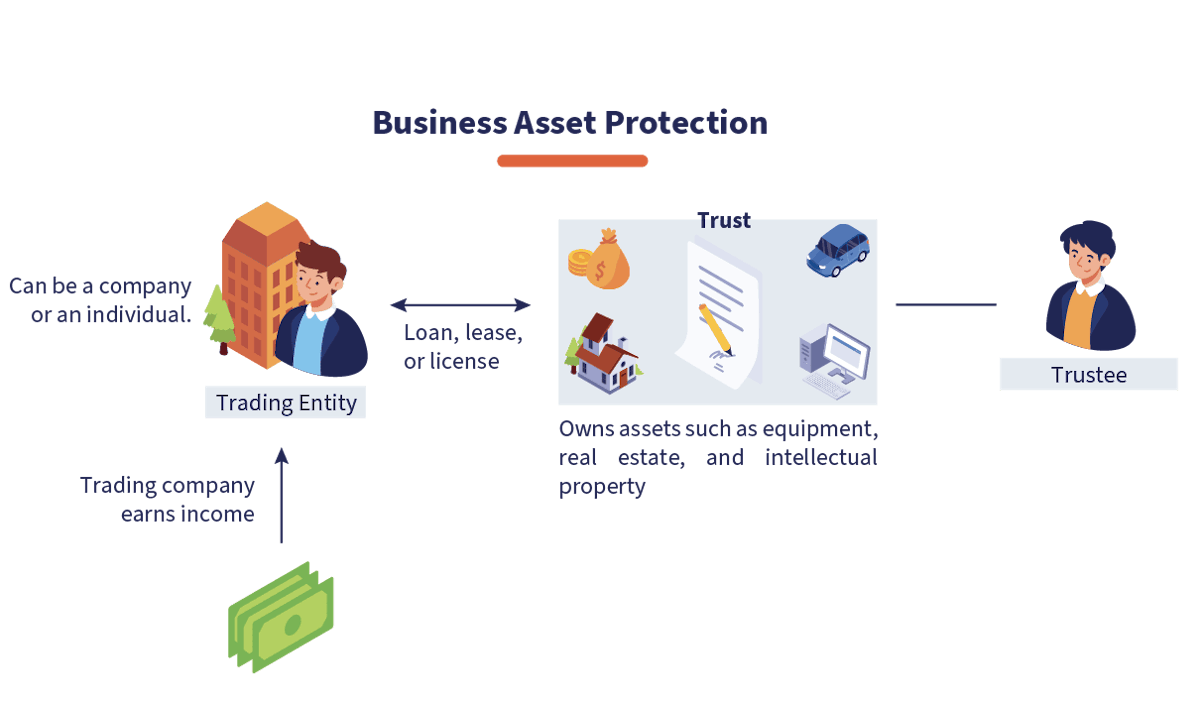

Business Protection

Domestic Trust vs Offshore Trust

Before the Alaska Trust, those seeking protection from creditors were forced to go overseas. Several domestic jurisdictions thus redrafted their Trust laws to directly compete with Offshore Trust havens. Some changes included allowing Self-Settled and Dynasty Trusts while shortening the statute of limitations to contest transfers. With such benefits available domestically offshore jurisdictions became less favorable.

There remain, though, legitimate reasons to establish an Offshore Asset Protection Trust for high-net-worth individuals with significant disposable assets. Alternatively, clients may choose a domestic Trust with a Swiss Bank Account utilizing our partners at Swisspartners Advisors Ltd. (SPA) for the best of both worlds. We refer to this as hiding in plain sight via a Wyoming Domestic Asset Protection Trust (DAPT).

Revocable vs. Irrevocable Trusts

A Revocable Trust is an estate planning tool for bypassing probate. It does not provide asset protection or help to avoid estate taxes. The Trust can be dissolved or revoked at any time, e.g. if a judge orders the Trust's assets to be used to pay personal debts.

An Irrevocable Trust is treated as its own person in the eyes of the law. For this reason, it cannot be revoked by a judge to pay your debts. The Trust is its own entity with its own rights under the eyes of the law.

However, do not let the term 'irrevocable' scare you. The Trust can be drafted to allow you to change beneficiaries at any time and for any reason. You may also act as your own trustee or appoint and remove other trustees at your discretion. Distributions must be approved by you and you may invest or use the Trust's assets as you wish.

Choosing a Wyoming Trust Company

Every Wyoming Irrevocable Trust is required to have a trustee. The trustee may be a Public Trust Company service offered by a bank or similar institution. This is also referred to as an independent trustee.

These are generally desirable if a beneficiary, such as your child, is not financially responsible or has a drug problem. In such situations, a Public Trust Company may help your children make wise investment decisions.

Those desiring more privacy or control may act as their own trustee. This is done via a Wyoming LLC which acts as your own personal Private Trust Company (PTC). The PTC is anonymous, controlled by you, and reduces costs. This option is discussed in further detail below.

Assets That Cannot Be Protected

A DAPT does not protect the following assets:

- Court-mandated child support can pierce a Trust.

- Assets pledged as collateral for loans.

- Fraudulent transfers.

As can be seen above, the Wyoming Asset Protection Trust protects almost any type of property; however, when conducting the transfer, you must also affirm as follows:

- You have the right to transfer the property;

- You are not insolvent;

- The intent is not to defraud;

- There is no pending litigation;

- You cannot be more than 30 days delinquent for child support;

- You are not contemplating Bankruptcy; and,

- You must maintain personal liability insurance for the lesser of one million dollars or the value of Trust transfers.

Requirements

The requirements for setting up and maintaining your structure include:

- A Wyoming Domestic Asset Protection Trust (Qualified Spendthrift Trust) is formed by you under Wyoming law.

- There must be at minimum one qualified trustee serving as Trustee. You may not be a trustee.

- Your trustee can be a Wyoming resident (not recommended), or a Trust company (Private Trust Companies are allowed).

- A Single Family Private Trust Company (domiciled in Wyoming) is generally preferred.

- You may remove and replace Trustees as you wish.

- The Trust is irrevocable, but modifications can be made, including but not limited to adding and removing beneficiaries and trustees.

- The Trust must list beneficiaries. These can include but are not limited to you and your family, friends, pets, and charities.

- The trustee generally retains the authority to oversee the Trust and manage distributions.

- You may, however, act as an investment adviser. This allows you to approve, disapprove, and direct a Trustee’s actions.

- You may allow or disallow distributions.

- Maintain a registered agent in Wyoming..

Do Wyoming Trusts have any risks?

- Conflicting State Laws: Every state's Trust laws are different. There are states which do not allow Self-Settled anti-creditor Trusts or do not have as beneficial of terms. There exists little precedence for how courts shall decide when the laws of states conflict. It is advisable to take one of two courses. First, you establish a Domestic Asset Protection Trust in your state of residence. If your state does not have favorable Trust laws, then assets should be held within Wyoming via a business entity, bank, etc. This worry is partly limited by the Constitution's Full Faith and Credit Clause

- Going Bankrupt: There is a ten-year look-back period for transfers to Asset Protection Trusts when you go bankrupt. If you are found to be intentionally defrauding an investor, then the assets in the Trust will not be protected from bankruptcy proceedings for ten years.

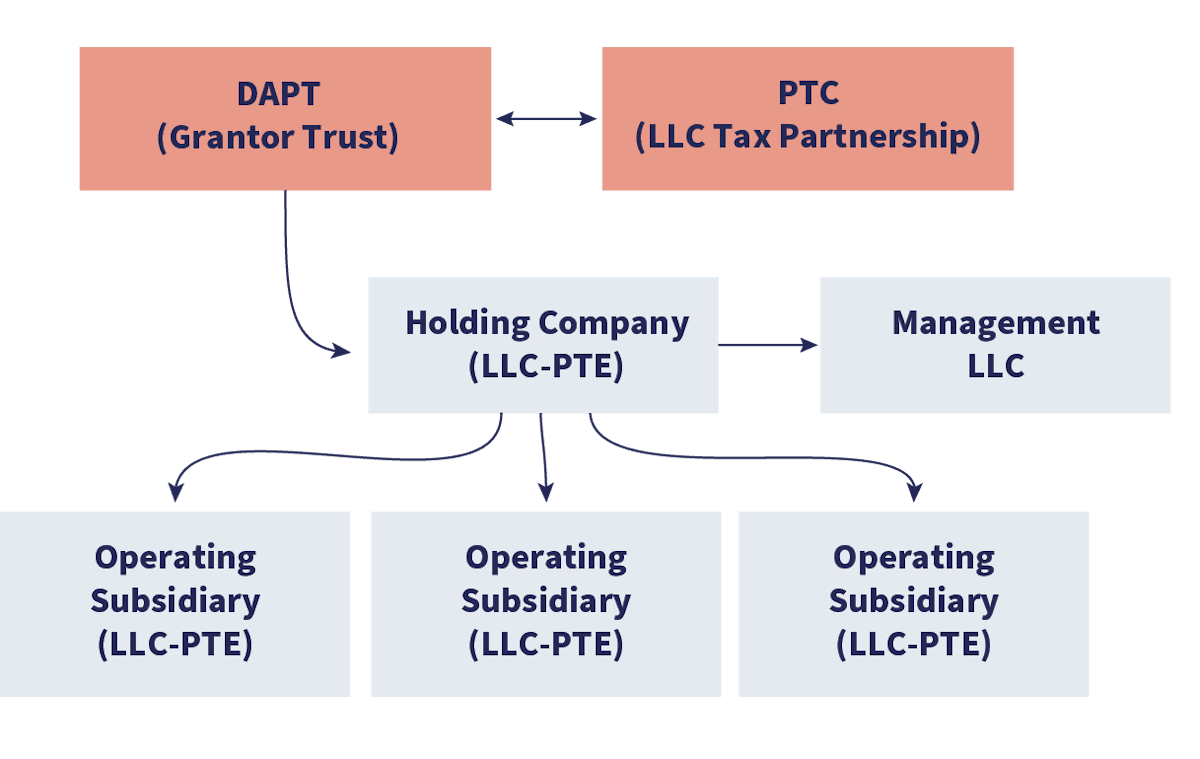

Domestic Asset Protection Trust Structure

Closing Thoughts

Establishing a Wyoming Asset Protection Trust offers a comprehensive solution for safeguarding your assets, providing anonymity, and optimizing your estate planning. The flexibility and robust legal framework of Wyoming Trust laws make it an attractive option for various Trust structures, including self-settled, dynasty, perpetual, and Medicaid Trusts. The benefits of a Wyoming DAPT, coupled with a Wyoming LLC, extend beyond creditor protection.

For those seeking more information, the Frequently Asked Questions section below provides valuable insights into the nature and functioning of Wyoming Asset Protection Trusts.

Frequently Asked Questions

Trust laws are determined at the state level, and Wyoming is one of the few states that allow individuals to form Asset Protection Trusts for themselves. The Trust provides asset protection and privacy from creditors and bankruptcy.

Thirteen states allow individuals to form Self-Settled Trusts, whereas all states allow you to form third-party Trusts for asset protection. The difference is whether the Grantor and Beneficiary can be the same.

An Asset Protection Trust has its own rights under the law. When it holds assets they are outside a person's estate and cannot be attacked by creditors. Wyoming has the strongest domestic asset protection Trust laws in the United States.

The answer is: That it depends. A Revocable Trust does not provide asset protection. An Irrevocable Trust can provide asset protection if drafted correctly.