- Non-Charitable Purpose Trusts

Non-Charitable Purpose Trust

PTC and NCSP Benefits

One of the principal benefits of Wyoming Trust law in the context of an Asset Protection Trust (“DAPT”) is the use of a Wyoming Private Trust Company (“PTC”) as a Trustee. The PTC is registered with the Wyoming Banking Commission but is not regulated because of an exemption for Trustees acting for a single “family.” This allows the settlors of the DAPT to maintain substantial management and control over the workings of the DAPT. Control through “Directed Trusts” is also allowed by Wyoming and this further enhances the use of a DAPT. This factor, control, is unique to Wyoming and has been instrumental in establishing Wyoming as a preeminent Trust jurisdiction.

In addition to control, confidentiality for the PTC is a paramount issue. In this instance the formation of the Trustee as a PTC in Wyoming is anonymous. An additional level of protection is attained by establishing a Non-Charitable Special Purpose Trust (“NCSP”) solely for the purpose of owning the membership interests in the PTC and providing further oversight to the DAPT. There are no registration or disclosure requirements for an NCSP in Wyoming. The ownership of the PTC is anonymous. The use of the NCSP for ownership of the PTC immunizes the PTC from an attack on the settlors of the DAPT because the NCSP owns the outstanding PTC membership interest and the settlor is not a beneficiary of the DAPT. Thus, the settlor has no property interest in either the PTC or the NCSP.

Purpose Trust Overview

An NCSP is in this instance an unconventional Trust in that it is formed to hold the PTC membership interest but has no beneficiary. A Trust protector or enforcer is appointed to oversee the activities of the PTC. The Grantors have no interest in the NCSP.

There are three requirements under the common law of Trusts for a valid Trust. First, a Trustee, second, Trust property and third, an ascertainable beneficiary. RESTATEMENT (SECOND) OF TRUSTS §124 (AM. LAW INST. 1959). A statutory exception has been created in Wyoming for the third requirement in order to allow for the creation of an NCSP to hold the membership interest of the PTC, which acts as the Trustee of your DAPT. (W.S. §§4-10-410 and 4-10-504.)

We recommended that you appoint a Trust protector or enforcer with powers to enforce the purpose of the NCSP. The following should be considered in organizing your NCSP:

- What is your specific objective or purpose?

- How much property should be placed in the NCSP in order to achieve these objectives?

- What should the duration of the NCSP be?

- How will the NCSP’s terms and purpose be enforced in the absence of human beneficiaries?

- How can the NCSP be modified or terminated?

Interaction of PTC and NCSP

The PTC, then, is privately owned by the NCSP and acts as a Trustee exclusively for a wealthy Family Trust or group of Trusts. The PTC board would be populated with professional advisors and family members. The PTC is generally at the heart of the “Family Office.” There are a number of advantages:

- The PTC allows the family to establish the Trust to retain a greater degree of control over Trust affairs without compromising the DAPT’s validity. In particular, families can participate in investment, administrative, and other established committees, and with certain qualifications, they can also have a say in the distribution committee, potentially granting the individual creating the Trust the authority to block distributions.

- The PTC board has greater personal knowledge of the family’s business and financial affairs and is more sensitive to the range of family interests that present themselves.

- The PTC avoids the need for future changes in the trusteeship and assures control over succession since the PTC can be perpetual.

- The PTC board has an intimate knowledge of the DAPT’s purpose.

- The PTC can, if you dilute or absolve the Prudent Investor Rule, retain illiquid and non-producing and other family assets that a Public Trust Company would not entertain.

- Individuals have personal liability when acting as a Trustee; however, a member of the board of directors of a PTC has less exposure, and in Wyoming, there are rigid credit rights prohibitions.

- The PTC can create and maintain common Trust funds of all the assets held in the various Trusts over which it is the Trustee, reducing fees and expenses.

These factors allow the PTC to deal with sensitive family issues more freely and with greater speed and flexibility.

One final factor to consider is that professional Trustees are generally reluctant to take ownership of assets or participate in ventures where substantial risks may be present. A PTC with proper board composition allows for riskier investments to be included in the Trust fund since the assessment will be based on a broader scope of experience from a properly constituted board.

Wyoming is one of the few states that through its regulatory board has allowed PTCs to be totally unregulated. This can be a substantial benefit for the following reasons:

- Capital Requirements: There are no capital requirements and the only fees are the annual report filing fee of $60 for the PTC and any registered agent fee.

- Presence or Minimum Contact Requirements. The only statutory requirement for “presence” in Wyoming is a state-qualified registered agent; however, best practices dictate more and could include opening a bank account in Wyoming; maintaining an office in Wyoming; appointing a Wyoming resident as one of the directors; and having directors or officers of the PTC perform some tasks in Wyoming.

On the federal side, the IRS issued Notice 2008-63 in 2008 to guide the PTC’s structure:

- A “board” consisting of family and non-family members responsible for the overall management of the PTC.

- An “investment committee” is responsible for the investment of Trust assets.

- A “discretionary distribution committee” to review beneficiary distribution requests. IRS Notice 2008-63 provides that no family member serving on this committee should participate on this committee if that family member or his/her spouse is either a grantor or a beneficiary. (Consider: different sub-trust committees.)

- An “amendment committee” with authority to amend the PTC’s governing documents, which would be something akin to a Trust Protector.

- Family members are not allowed to enter into “reciprocal agreements” as to discretionary distribution decisions.

- Only officers of a corporation or managers of an LLC can participate in “personnel decisions.”

The PTC can be a Trustee for your DAPT if it complies with Wyoming law by providing the following: (i) a Wyoming LLC owned by (ii) a Wyoming DAPT administered by (iii) a Wyoming PTC.

Overview of Family Office

The family office is established to manage a family’s financial and personal needs through a long-term vision of wealth management and the pages of values to future generations. Many families have diversified private fortunes accumulated over many years, which presents a level of complexity and complicated family situations.

The family office centralizes management within a private, professionally staffed, tax-efficient structure, with defined decision-making and reporting lines. The staff are professional and committed to acting in the family’s best interests without conflicts of interest. A professional staff assists in solving problems by acting as impartial guides and a source of reliable and dispassionate advice while nurturing junior members of the family to gradually take a more active role in the family’s affairs.

The legal structure of the family office depends on many factors:

- complexity of the financial affairs;

- the tax domicile and residence of principal members;

- level of asset protection that may be required; and

- the wishes of the family itself.

- They provide a means by which a Settlor, or his family, can retain a greater degree of control over their Trust affairs without compromising the validity of the Trust(s).

- The Board of the PTC will have a heightened knowledge of the family’s business and financial affairs and be sensitive to the range of those interests, whilst also being empathetic to the needs of the beneficiaries, and having an intimate knowledge of the Settlor’s wishes. All of this should allow them to deal with sensitive family issues more freely and often with greater speed and flexibility;

- Having a PTC as a Trustee of Family Trusts will also avoid the need for future changes in the trusteeship;

- Professional Trustees are often reluctant to take ownership of assets or participate in ventures where substantial risks may be present, and a PTC (due to the composition of the Board) can enable riskier investments to be included in the Trust fund, (although the PTC will still have the usual Trustee obligations).

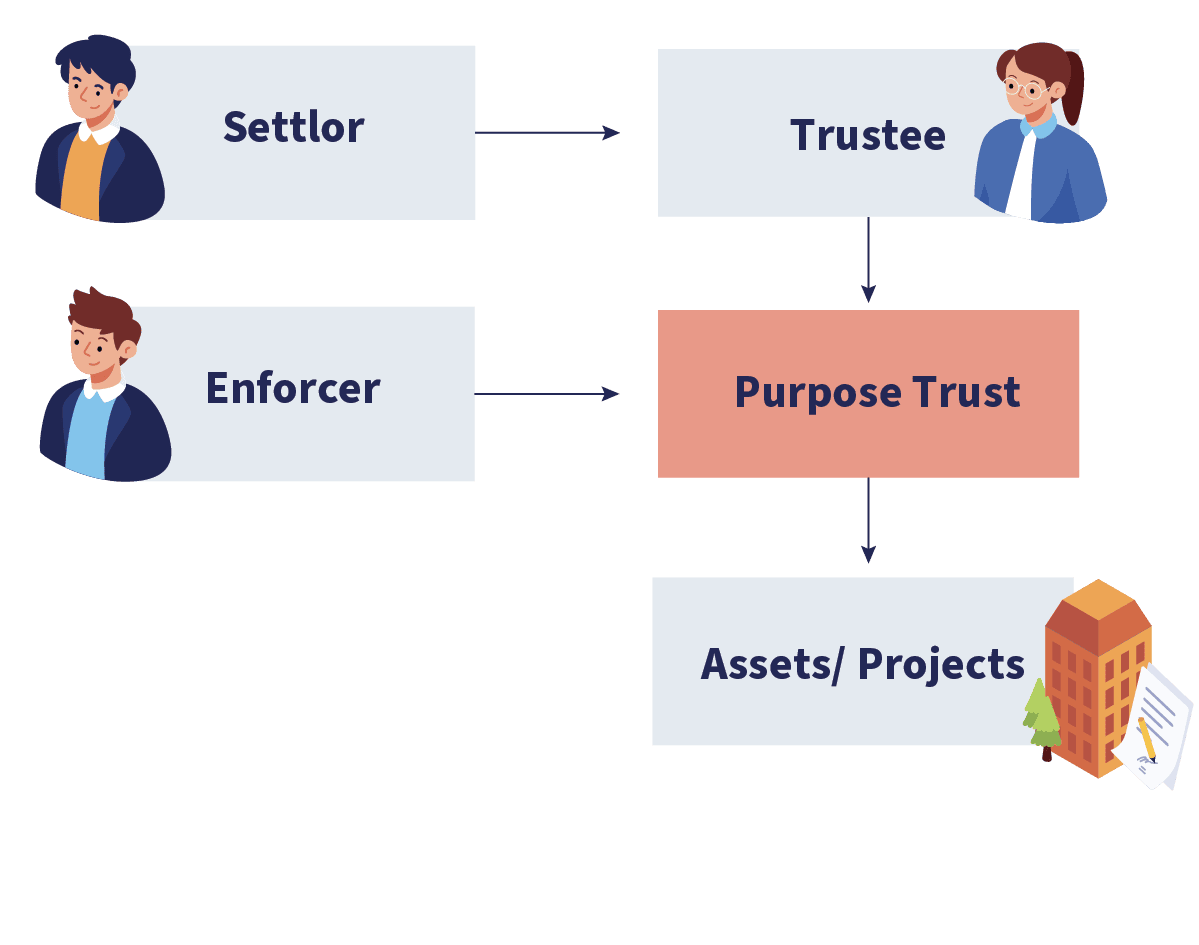

TYPICAL DIAGRAM OF A PURPOSE TRUST

- Settlor – Creates the Trust by transfer of assets into the Trust. A settlor may be an individual person or a corporate entity

- Trustee – Holds the Trust funds and is responsible for its administration in accordance with the purpose of the Trust

- Enforcer – Ensure that the Trustee utilizes the Trust funds for the specified purposes and that the Trustee acts in accordance with the terms of the Trust. This person must not be the same as the Trustee.

- Assets may include shares in private companies. The underlying companies could be under the management and control of the client without involving the Trustee. However, if the Settlor wishes to, the Trustee can manage and control the underlying companies.

A Non-Charitable Special Purpose Trust is essential in specific situations.

Concluding Thoughts

Wyoming's unique Trust laws offer significant advantages for Asset Protection Trusts (DAPTs), particularly when utilizing a Wyoming Private Trust Company (PTC) and a Non-Charitable Special Purpose Trust (NCSP). These structures provide unparalleled control and confidentiality for settlors, allowing for effective oversight of DAPTs. Considering the complexities involved, consulting with an experienced estate planning attorney is advisable for those seeking to maximize the benefits of these Trust arrangements.