- California LLC vs. Sole Proprietorship

California LLC vs. Sole Proprietorship

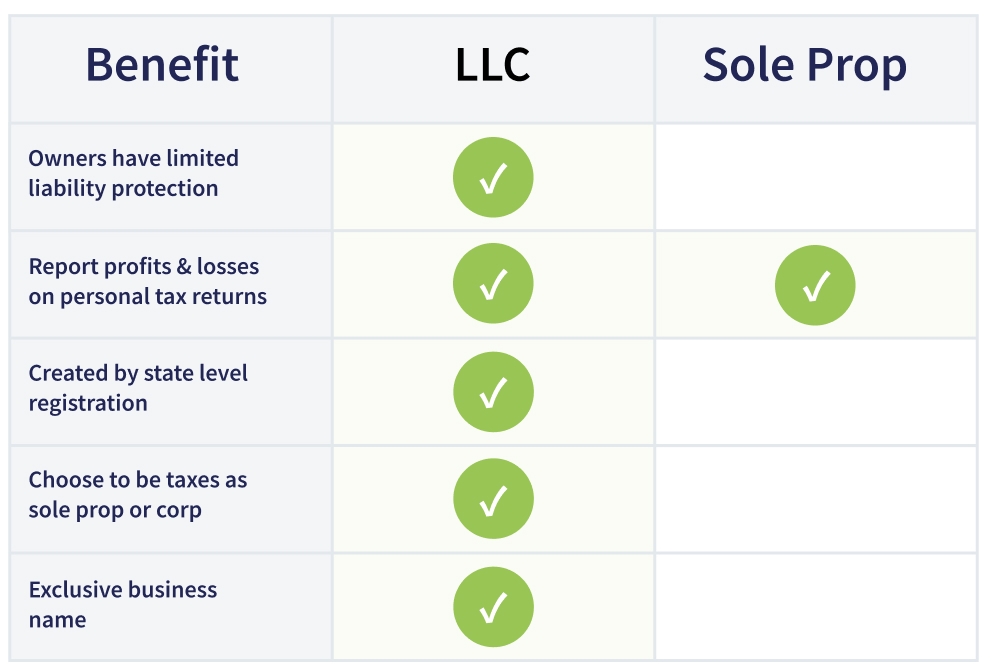

Limited liability companies (LLC) and sole proprietorships are two main business structures with advantages and disadvantages. The choice of which business structure is an important one. Small business owners favor either LLC or sole proprietorship for flexibility and simplicity, each structure offers different benefits.

The choice you make will depend on your business characteristics and situation. When selecting your business structure, some things to consider include fees, requirements such as an operating agreement, federal regulations and how they may impact your business, liability protection, and tax implications. We will specifically discuss these business structures in California, focusing on the annual report obligations, the option for a single member LLC, the importance of asset protection, and the possibility of forming an anonymous LLC.

What Is an LLC?

An LLC is created at the state level and is a legal entity that exists separately from its members. The defining characteristic of an LLC is that members are not liable for the debts and obligations of the business. The advantages of an LLC can include that potential tax savings can pay for formation costs, liability protection, privacy (if formed anonymously), and being seen as more professional. The only possible disadvantage with an LLC is the added complexity compared to sole proprietorships.

What Is a Sole Proprietorship?

This is the simplest and most common structure chosen to start a business. It is an unincorporated business a single individual runs. There is no distinction made between the owner and the business. An advantage of sole proprietorships is mainly its simplicity and flexibility. Because there are no other members, the sole proprietor is free to make business decisions without necessarily having to consult other members as long as the decision is within the legal confines of the state. Disadvantages of sole proprietorships include paying more taxes due to being considered earned income, difficulty in raising or growing profits, unlimited liability, and consumers viewing the business as less professional.

What Is the Difference Between the Two?

Generally, sole proprietors own small or part-time businesses with no employees. It costs nothing to establish a sole proprietorship. Unlike a sole proprietorship, an LLC is a hybrid of the partnership and corporate forms that allows the liability protection of a corporation with the tax advantages of a partnership.

How Does the Startup Process Differ?

Sole proprietorships are relatively straightforward to form. There's nothing specifically needed to form this business structure. Any person selling goods and services without other partners operates a sole proprietorship. Depending on the location of your business, you may need to apply for zoning permits or business licenses to operate legally. As with any business structure, if you are running your sole proprietorship under a trading name, you need to submit a DBA or "doing business as" certificate to apply for the business name.

For an LLC, you may also need to file a business permit and a DBA (if working under a trading name). However, for an LLC, you also need to file a document termed the articles of organization. This document must be filed in the state you are operating and establishes your business's existence. There is a cost that ranges between $50 to $200, depending on the state you're filing with. In California, the fee to file for an LLC is $70. Ninety days after establishing an LLC in California, you must also submit a Statement of Information that costs an additional $20 to file. The statement of information is a required filing in California that keeps the Secretary of State updated about any information concerning the company members.

How Do These Business Entities Differ in Their Management and Operations?

A sole proprietorship is simple in its operations, and management structure as the single owner can make any business decision as they see fit independently. Most sole proprietors can hire employees, experts, and other individuals to help with day-to-day choices in business management. However, the owner only has to ensure that their business operates legally and that the profits cover business expenses.

An LLC's operational and management structure is more intricate. Often it is outlined in an LLC operating agreement. The operating agreement details each member's stake in the business, voting rights, and profit share. The LLC can be collectively managed by all the members or an appointed manager.

Decision-making is often in proportion to the ownership stake in an LLC. For instance, a 20% owner would have a 1/5 vote on decisions. This also applies to business profits. That is, a 25% owner would earn a quarter of the business profits.

How Do They Differ in Liability?

The owner of sole proprietorships is personally responsible for business debts. If the business goes bankrupt, the owner must file for personal bankruptcy. If someone sues the company, they can name the owner and go after personal assets.

LLC protects members' individual assets and is considered legally separate from the owner. If the business undergoes bankruptcy, the owner is not responsible for paying the business personally.

How Do They Differ in Their Paperwork and Compliance Measures?

Sole proprietorships do not have many paperwork obligations. There is little paperwork necessary to file when launching this business structure. The sole proprietor must file their federal, state, and local taxes. They may also need to renew business permits. Visit the California government website to view the required permits for your California sole proprietorship.

LLCs have more compliance responsibilities than sole proprietorships. LLCs file annual reports in many states and, with more members, have more responsibilities. These include drafting an operating agreement, recording changes in ownership, and holding member meetings. These actions are not legally required but help maintain liability protection for members.

What Are the Different Options for Taxation of LLC & Sole Proprietorship?

Single-member LLCs and sole proprietorships file their taxes similarly. The businesses themselves do not pay income taxes. Instead, the owner reports their business income through their personal tax return on a Schedule C. Therefore, the income gets taxed at the owner's personal tax rate. If you are a California nonresident, you must complete Form 540NR when you file your taxes.

Multi-member LLCs are similar in that owners report their share of business income on their personal tax returns. However, a multi-member LLC must also file a business tax return, Form 1065. Also, each member must fill out Schedule K-1 and attach it to their personal tax return, showing their share of the business's income.

On top of income tax, there may be additional tax responsibilities. Regardless of your business structure, you must pay payroll taxes if you have employees. State and local sales taxes are also necessary to sell taxable goods or services. If you are self-employed, you must also pay self-employment taxes which cover your social security and medicare obligations.

Some states also require additional taxes on LLC business structures. An essential difference between LLCs and sole proprietorships is tax flexibility. Only LLC members can choose how they prefer to have their business taxed. They can also elect to have corporate tax status. Dividends are taxed at a lower rate than typical business income when the company is taxed as a corporation. Corporation retained earnings are also not subject to income tax. LLC members must pay taxes on all business income, whether retained or not. A corporation has eligibility for additional tax deductions and credits. For more information concerning tax liability for a California LLC, visit the State of California Franchise Tax Board website. Note that every California LLC is required to pay an $800 tax fee annually. You can pay your taxes online or mail your annual taxes to the following address:

Franchise Tax Board PO Box 942857 Sacramento CA 94257-0631Should You Start an LLC or Sole Proprietorship?

Business owners often start with sole proprietorships. It requires minimal paperwork and is simple in design, as shown previously.

Once the business grows, transitioning to an LLC may have the advantage of offering protection against personal liability for bankruptcy.

Who Is an LLC Best for?

Those who want personal liability protection, tax benefits, growth potential, credibility, and consumer trust should strongly considerforming an LLC. It is recommended that businesses with more extensive customer bases, increased risk of liability and/ or loss could potentially benefit from unique tax options and have the possibility for immediate sustainable profit. One immediate downside is the fees and more complex formation process than sole proprietorships. However, this can easily be made up for with the benefits your business can assume by establishing your company as an LLC.

Who Is Sole Proprietorship Best for?

Sole proprietorships are ideal for small-scale, low-risk, and low-profit businesses. Therefore, the risk on an owner’s personal assets is minimal. This business structure is ideal for low-profit and low-risk, with a smaller customer base, starting out with hobbies such as photography, blogging, or video streaming.

The best business structure will depend on many factors, and it's recommended that you speak to a business lawyer before deciding.

For more on forming an LLC in California, see our guide to forming an LLC in California, including requirements, articles of organization, registered agent, operating agreement, and annual report. Explore benefits, taxes, asset protection, single-member LLC, dissolution, business search, and corporations. Visit our homepage and blog for more.