- Self-Directed 401(k) LLC

By Andrew Pierce

Self-Directed 401(k) LLC

Control Your Retirement - $750

Solo & Self-Directed 401K LLC

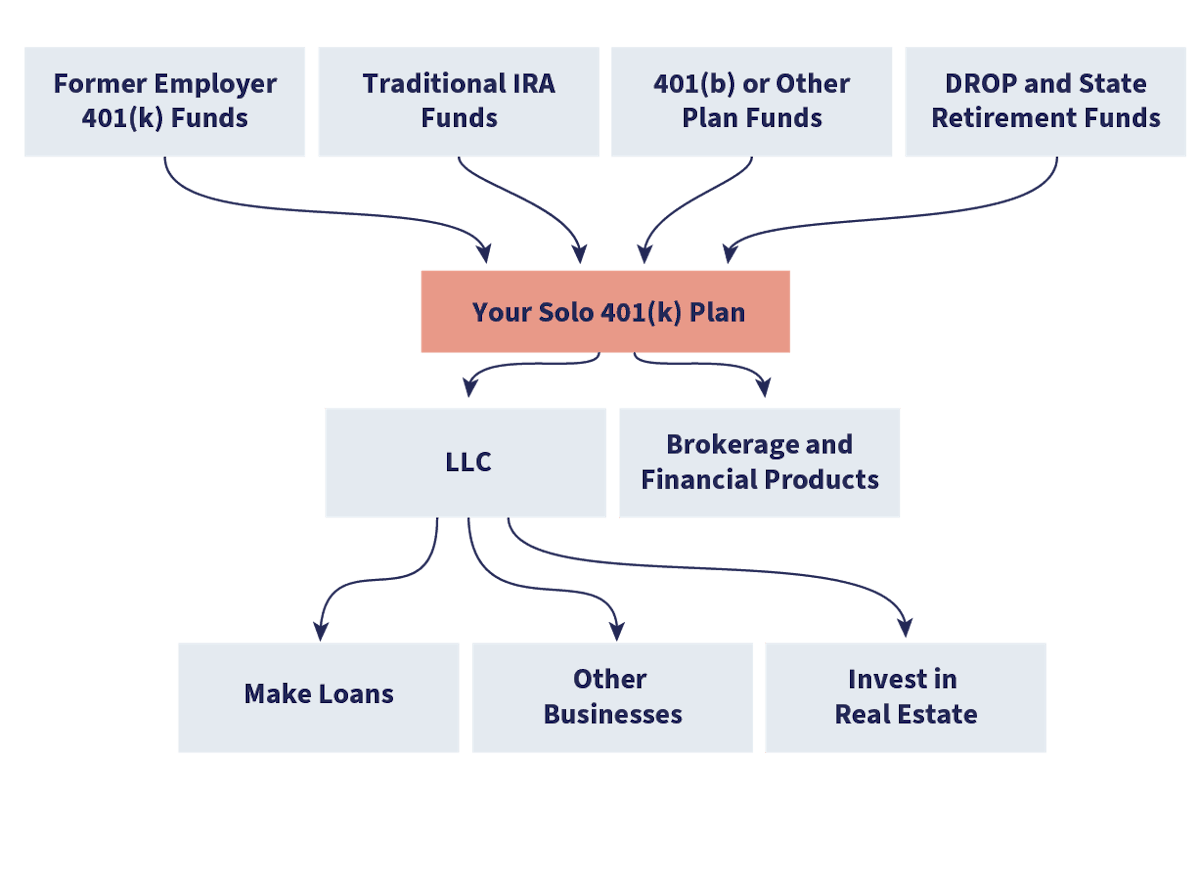

The Solo 401k LLC has two separate, but related, parts. They are the ability for an entrepreneur to establish their own retirement fund, and the ability for anybody with a retirement fund to invest in an LLC. Qualified retirement plans (401k, IRA, TSP, etc.) are commonly associated with employers and traditional brokerage investments. That is, your employer contributes, except in the case of an IRA, and you invest in stocks and bonds. This conception merely scratches the surfaces of what is possible.

| Service: | Self-Directed 401k LLC Formation |

|---|---|

| Cost: | $750 |

| Turnaround: | 24 Hours |

| Benefits: | Higher contribution limits of $54,000+, Contributions are tax-deductible, Earnings compound tax-deferred |

Setting up a 401k for your own benefit is surprisingly easy. All you need is a company, even a brand new one we have just formed for you. The benefits of such an arrangement are:

- Higher contribution limits of $54,000+

- Contributions are tax-deductible

- Earnings compound tax-deferred

- The ability to invest in an LLC

Existing retirement accounts can also be rolled into the 401k we set up for you. Once the 401k is funded, you will invest the 401k in a Wyoming LLC. This turns your retirement fund into an investment vehicle with advantages such as:

- Significantly lower taxes

- Freedom to invest as you see fit

- Better asset protection than a traditional LLC

- No need for a custodian or a trustee's permission - and thus no fees

Two reasons for pursuing this arrangement are wider latitude investing and the ability to bypass a custodian. The process is simpler than you would think. Most clients can begin investing in fewer than two weeks. Here are just a few of the ways you may invest your Solo / Self-Directed 401k LLC:

- Real estate and rental properties

- Loan money to yourself or other businesses

- Invest in precious metals

- Tax liens

- Stocks, bonds, mutual funds etc.

Need more flexibility than a traditional retirement account can provide? Then you may want to consider establishing a Wyoming asset protection trust.

What You Get

When you hire us, the method is relatively straightforward. We will put you in touch with Advanta IRA which can assist with rolling over your existing account and forming your new 401k. We will then create an LLC wholly owned by the 401k and help set up your bank account.

Self-Directed IRA/401k LLC Operation Agreement

Generally, the operating agreement of a Self-Directed 401(k) LLC must contain specific sections pertaining to “Investment Retirement Accounts” and “Prohibited Transactions” as dictated by IRS Code Sections 408 and 4975. Further, it must be a "Manager Managed" limited liability company. For the remainder of this paper, I will refer to an IRA and 401 as you’re your “IRA” or “tax-deferred fund.”

Some Important Things To Remember

- You are the IRA owner

- Your IRA will own 100% of the LLC

- You do NOT own the LLC

These things may seem self-evident, but it is easy to get confused about these issues and confusion leads to mistakes. The entire tax benefit depends on these facts.

Now, please remember the following: For single member LLCs, such as your tax deferred plan, the Operating Agreement is of little practical use. It is only an agreement with yourself, which means you can change it at any time for any or no reason. In fact, in Wyoming, you are not required to have one. The bottom line is: “It is not what you say, but what you do, that is important.”

For example: You could include a line item in your Operating Agreement that states you will not engage in any “prohibited transactions”; however, if you are found to have dealings with a disqualified individual, you will still be in trouble, regardless of what you wrote in the Operating Agreement. In fact, it may even go worse for you because the Operating Agreement will demonstrate that you were aware of the infraction beforehand.

Why do you need an LLC Operating Agreement?

You need the Operating Agreement for two reasons:

- Your bank will require you to provide them a copy when you set up the LLC account

- Your custodian will require you to provide them a copy when they set up the Self Directed IRA Account

Rules specific to a Self-Directed IRA or 401K

The primary way that an Operating Agreement for a Self-Directed IRA with checkbook control differs from a standard LLC Operating Agreement is how the IRS rules for Self-Directed IRAs and 401Ks are handled. If you don’t follow the rules, you can risk the tax-deferred status of your account. This could lead to the disqualification and result in severe tax consequences.

Here is what you need to know: At a minimum, your Operating Agreement must contain language to handle the following:

Prohibited Transactions and Investments: This is basically self-dealing and certain investments such as collectibles.

Disqualified Individuals: You may not buy an investment from or sell an investment to a “disqualified person.” You and your family members are disqualified individuals. The list is longer for IRS purposes, but these are the primary disqualified persons.

Indirect Benefits: The purpose of your pension is to provide for your retirement in the future. It is considered to be an “indirect benefit” if your tax-deferred fund is engaged in transactions that, in some way, benefit you personally today.

UBIT: This is a tax that occurs when leverage is used to develop profits in investments.

Additional IRA LLC Rules

Here are some additional rules that apply because we are forming an LLC for the purpose of checkbook control of your tax-deferred funds.

- The same IRA prohibited transaction rules that apply to an IRA apply to an IRA LLC.

- An IRA may be a member of an LLC through the purchase of LLC units.

- When an IRA is the sole member of an LLC, the LLC is deemed a single member LLC and thus classified as a disregarded entity. As such, an LLC where the single-member is an IRA, the LLC does not file a Federal business-tax return.

- IRA can own a 100% of a newly formed LLC. Important: It is imperative that the LLC is newly registered and units issued for the first time. If not, the transaction may be deemed aprohibited transaction.

- The manager of the IRA LLC may not be compensated if the manager is the IRA owner or a disqualified party (e.g., the IRA owner’s spouse, kids, parents, etc).

- IRA LLC investments must be titled in the name of the LLC not your name or in the name of the IRA.

- IRA LLC bank account may not to be co-mingled with your personal funds.

- Investment gains and expenses must flow through the IRA LLC bank account. Therefore, if the LLC invested in a fixer-upper, you may not pay for such repair expenses with personal funds but rather use IRA LLC funds.

- IRA owner is prohibited from personally guaranteeing debt on behalf of the IRA LLC. When an LLC obtains a non-recourse loan from a . third party, usually for investing in real estate, the LLC must secure the loan and thus LLC funds must be used to make the loan payments. I don’t use leverage like this because I just don’t want to fool with the UBIT rules.

- Annual IRA contributions and IRA/401k transfers must flow to the self-directed IRA not the IRA LLC.

Frequently Asked Questions

Yes, a Solo 401(k) can own an LLC as a Solo is in most circumstances also Self-Directed (which is the most important part). Given you direct the investments you may invest in, funds may directed into an LLC for additional asset protection, privacy or other benefit.

Can owners of an LLC contribute to a 401(k)? Solo 401(k) plans are not limited to sole proprietorships. Businesses that are structured as limited liability corporations (LLC), as well as partnerships, may also participate in these plans if they meet all the eligibility requirements.

You do not need an LLC for a Solo 401(k), but we recommend one for anonymity, asset protection and potential tax savings. An LLC is almost always preferable to operating a Sole-Proprietorship.

Yes, a self-directed 401(k) can own an LLC. Those directing their retirement plans and investing in risky assets, such as real estate, are strongly advised to use LLCs for liability protection. One bad investment can affect your entire retirement portfolio if the 401(k) is not structured correctly.

The federal tax law allows employees to participate in their employer's 401k plan to take advantage of the tax deferral on contributions to the retirement account. However, if you are a self-employed member of a small business that operates as an LLC, the IRS allows you to set up a 401k plan for yourself.

Yes, a single-member LLC can contribute to a 401(k). There are strict rules surrounding Solo 401(k)s, but generally there may be no other members or employees for a contribution to be made. This simplifies reporting requirements, act as a tax deferment strategy and provides asset protection unavailable via other investment strategies.

A Solo 401(k) allows matching to enable annual contributions of over $50,000 per year. Precise rules must be followed, though. Please reach out should you need a recommendation for a reputable 401(k).