- North Carolina Business License

North Carolina Business License

What is a business license?

A business license is any type of license or permits that a government entity requires you to have to conduct business. There are several types of licenses and permits required with different business licenses. They can be issued by federal, state, or your local government.

Do I need a business license?

Whether you need a business license to run your business depends on what state your company is located in. Below are some common reasons you need to apply for a business license.

- If you are a brick-and-mortar business, you may need a permit to operate and allow commercial activity on your business property. A brick-and-mortar business is a physical location where owners may showcase their products utilizing a physical storefront. Customers can then visit the property to peruse the store, speak with sales representatives, try on products, and purchase any goods. The municipality you’re in might also need permits for certain things such as signage and fire safety. Examples include specialty stores, convenience stores, grocery stores, and drugstores.

- If you are selling products, most states, including North Carolina, require you to obtain a seller’s permit. This permit enables you to collect sales tax from your customers.

- You will need to obtain industry-specific licenses if you provide any services where you need a license, such as a stylist, lawyer, medical care provider, or accountant.

Who issues business licenses?

Three jurisdictions issue licenses. These include state, local, and federal.

State Business Licensing

As mentioned above, you may need to apply for a seller’s permit if you sell any products. Seller’s permits are issued by the state and allow your business to sell products within the given state you have the permit. Other state licensing and permits can include the following:

- General business licenses

- Doing business as (DBA)

- Liquor licenses

- Medical Licenses

- Electrical permits

- Fundraising licenses

- Farming licenses

- Health Permits

- Real estate licenses

In North Carolina, many businesses are required to have a state business license. If you meet any of the following, you must obtain a business license with North Carolina State. The state-level permit in North Carolina is referred to as the Certificate of registration or license, also known as the seller’s permit. Essentially, it registers your company for North Carolina sales taxes and other taxes you may be eligible for.

- Sell property in retail

- Provide and sell any taxable services

- Rent or lease any taxable property in North Carolina

- Sell digital property

- Run a dry cleaner or laundry

- Provide rentals for living spaces

- Provide service contracts

- If you charge for entry into an entertainment facility

- Make marketplace sales

To obtain a business license in North Carolina, you must visit the Business Registration website and apply for a certificate of registration or license.

Furthermore, depending on your industry and profession, you may need additional licenses or permits. You can check North Carolina’s’ Registration, Licenses, and Permits website to see whether you need to apply for more licenses or permits.

Local Business Licensing

Local refers to the county or city you are operating in. The licenses and permits you need will vary depending on the location and business structure. Also, you may need to apply for multiple local business licenses or permits if you operate in multiple cities or counties.

Some example permits you may need to apply for locally are similar to those listed above for state permits and licenses. See the list below for some examples.

- General business licenses

- Zoning and construction permits

- Health permits

- Professional Licenses

For additional information, you can check with the local North Carolina city and county government offices where your business is located.

Federal Business Licenses and Permits

Certain activities are regulated by the federal government and require you to apply with them to obtain the appropriate business license or permit. Below are a list of some business activities that require you to apply for licenses with the federal government. The links for applying to the respective licenses are also included below.

- Agricultural: https://www.aphis.usda.gov/aphis/resources/permits

- Alcoholic beverages: https://www.ttb.gov/ponl/customer-support

- Firearms, ammunition, and explosives: https://www.atf.gov/about/mission-areas

- Wildlife and fishing: https://fwsepermits.servicenowservices.com/fws

- Nuclear Energy: https://www.nrc.gov/about-nrc/regulatory/licensing/fees.html

- Broadcasting (Radio and Television): https://www.fcc.gov/general/consumer-information-obtaining-licenses

- Transportation: https://ops.fhwa.dot.gov/freight/sw/permit_report/index.htm#obt

- Aviation: https://www.faa.gov/licenses_certificates

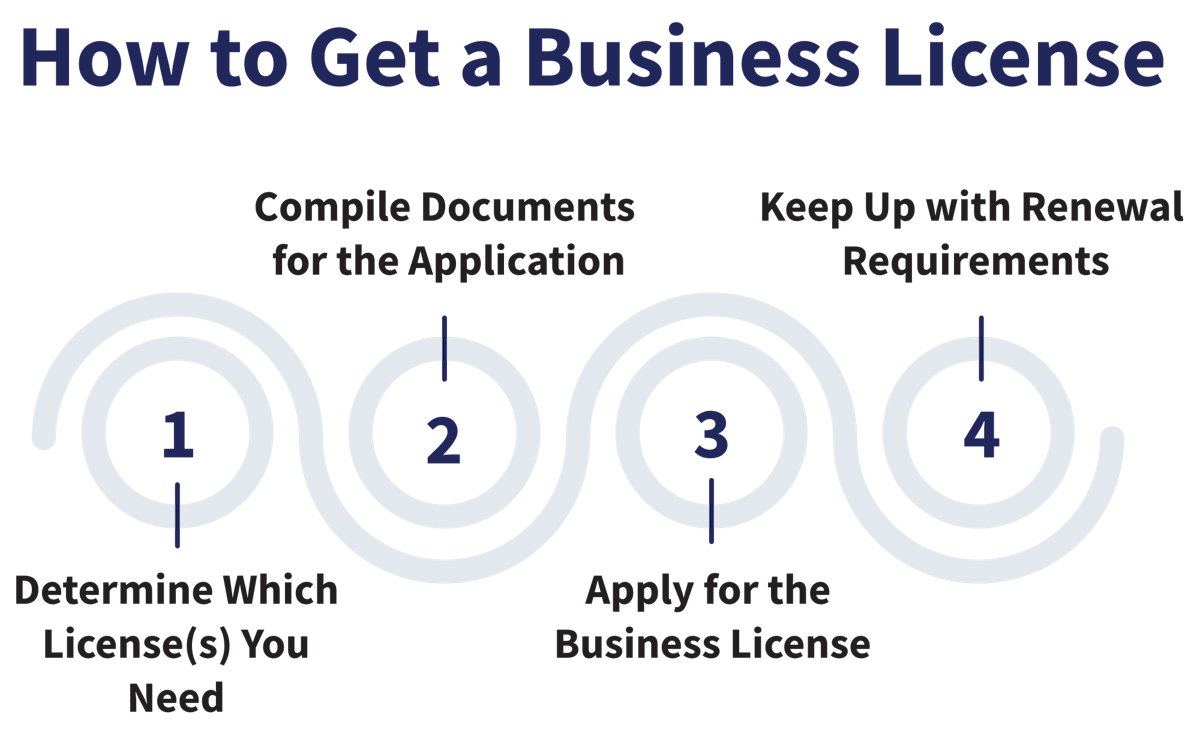

How do I obtain a business license?

You can file for a North Carolina Certificate of Registration or License either online or via mail. To apply online with the Department of Revenue, click here to open an account. You may also download the North Carolina Business Registration Application and send it to the following address. There is no fee to apply.

N.C. Department of Revenue P.O. Box 25000 Raleigh, NC 27640-0100How do I renew my license?

In North Carolina, the Certificate of Registration or License for the state sales and use tax renews automatically. Check with the local or relevant state government office to determine what other registrations or licenses you may need to renew.

Do I need a business attorney to apply?

No. Although not technically required, it can be helpful to consult a professional so that you know all the licensing requirements for your company. It can be challenging to navigate the different requirements of state, local, and federal agencies, so it may be a good idea to speak to a professional to ensure that your business is compliant.