- Utah LLC vs. Sole Proprietorship

Utah LLC vs. Sole Proprietorship

Operating as a sole proprietorship is a great way to get started in business because of the structure’s low cost. The only requirement to maintaining a sole-proprietorship is paying taxes on what you earn. However, sole-proprietors have no separation between their business and personal assets, which can lead to serious problems if they face a lawsuit.

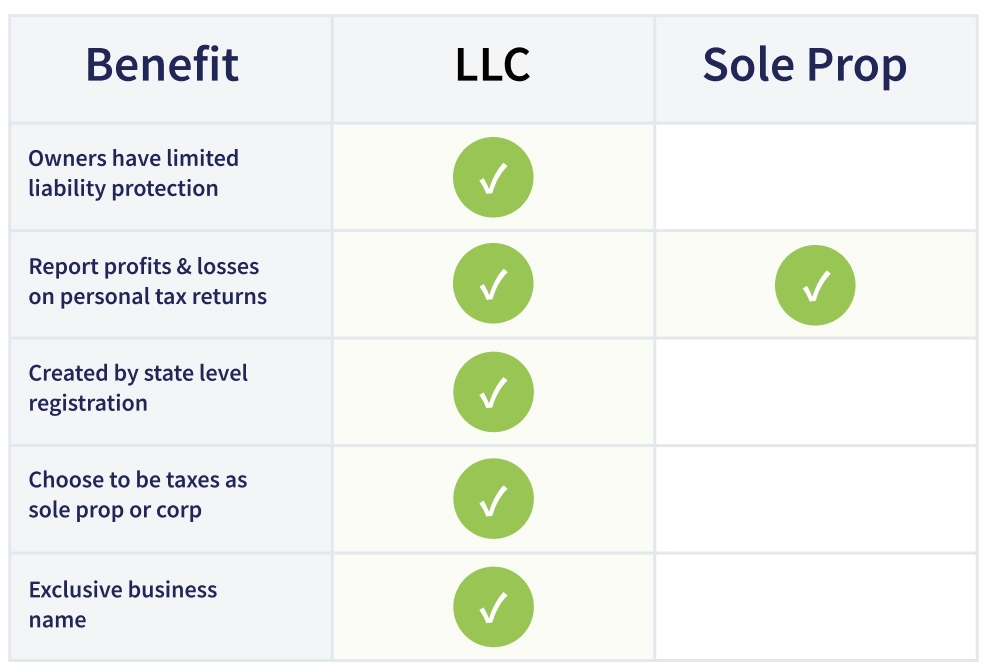

When you form an LLC properly, you get access to many benefits including asset protection and anonymity. If you’re currently a sole-prop, you can become a Single Member LLC. LLCs are slightly more complex than a sole proprietorship. They require internal documents, like an operating agreement, and require you file an annual report. Generally speaking, we find this slight increase in complexity is worth the benefits.

What Is an LLC?

A limited liability company (LLC) is a business structure where the owners are not personally liable for the company's debts or liabilities. It establishes the business as a separate entity from its members and owners. You can establish an LLC in most states including Utah.

What Are the Advantages and Disadvantages of an LLC?

LLCs offer several advantages that include tax savings, liability protection, privacy (if formed anonymously), increased credibility, and more tax flexibility. One potential drawback is the added complexity when compared to a sole proprietorship. See below for a list of the pros and cons of an LLC.

Advantages:

- Owners have significant flexibility when it comes to how to manage and organize their LLCs. Members can organize their company in almost any way they deem helpful as long as it is within the confines of their state's regulations. This includes choosing to have the company managed by its members or by appointed members.

- LLCs have several options on how to handle their taxes. One option for taxation includes pass-through taxation which is similar to how you would file your taxes if you were running a sole proprietorship. Pass-through taxation is where individual members report LLC profits on their own income tax returns. More information on taxation options is available below.

- There are fewer regulations for LLCs than for corporations.

- There are no limitations on the number of or who can be a member of an LLC. In Utah, it is also relatively easy to file paperwork to transfer ownership and change members of your LLC.

Disadvantages:

- Because of all the options available, it can be difficult to understand which option is best for your LLC.

- Tax and liability treatment can vary in different states. It can increase the complexity of running an LLC.

What is a Sole Proprietorship?

A sole proprietorship also referred to as a sole trader or a proprietorship, is an unincorporated business with just one owner who pays personal income tax on profits earned from the business. Most small businesses start off as sole proprietorships. It is the most straightforward type of structure to run your business. The business is treated as an extension of the owner.

In other words, unlike LLCs, there is no legal distinction made between the owner and the business. There are no necessary steps or paperwork you need to submit when operating a sole proprietorship. However, many people submit a “doing business as” request with their local county clerk’s office and obtain a Certificate of Assumed Name to take on an assumed name such as “Sprinkles and Cakes.” Without this certificate, the sole proprietorship must operate under the owner’s name, for instance, “Jackie’s Cupcakes.”

What Are the Advantages and Disadvantages of a Sole Proprietorship?

There are several pros to operating a sole proprietorship compared to other business structures, including mainly convenience and simplicity. With the convenience and simplicity, you may make yourself more susceptible to certain financial risks especially as your business grows. Below is a list of the advantages and disadvantages of a sole proprietorship.

Advantages:

- Straightforward and low costs to establish than compared to an LLC

- Minimal maintenance costs

- Owners have freedom and control over their business decisions within the limitations set by law.

- Business profits go directly to the owner. As a result, taxation is simpler. The owner can file their personal tax return and not worry about taxation at the business level.

- It is straightforward to convert a sole proprietorship to a different business structure. This can be helpful once the company grows and the owner desires protection from personal liability for the business’s debts or obligations.

Disadvantages:

- Sole proprietorship owners have direct liability for all the debts against the business. In other words, when a person sues your business successfully, the business along with your personal assets may be at risk.

- Sole proprietorship owners are more susceptible to higher tax rates as everything is considered earned income.

- Owners may be limited to using funds from their personal savings accounts or consumer loans to fund their business.

- Well-established employees may be less attracted to sole proprietorships compared to larger organizations. That is, sole proprietorships may have less credibility than other business types.

- As the only business owner, the demands and pressure lie only on you.

- The business entity dissolves when the owner passes away or retires.

What Is the Difference Between the Two?

There are several categories to help distinguish between sole proprietorships and LLCs. These include liability, taxation, and management/ operational style.

Liability

Generally, sole proprietors own small or part-time businesses with no employees. It costs nothing to establish a sole proprietorship. Unlike a sole proprietorship, an LLC is a hybrid of the partnership and corporate forms that allows the liability protection of a corporation with the tax advantages of a partnership. As hinted above, this is a crucial difference between the two business structures. Sole proprietors are not protected from personal liability.

Taxation

Generally, sole proprietors own small or part-time businesses with no employees. It costs nothing to establish a sole proprietorship. Unlike a sole proprietorship, an LLC is a hybrid of the partnership and corporate forms that allows the liability protection of a corporation with the tax advantages of a partnership. As hinted above, this is a crucial difference between the two business structures. Sole proprietors are not protected from personal liability.

Management and Operations

A sole proprietorship is simple in its operations and management structure. It is the single owner that can make any business decision as they see fit. Most sole proprietors can hire employees, experts, and other individuals to help with day-to-day choices in business management. However, the owner only has to ensure that their business operates legally and that the profits cover business expenses.

An LLC's operational and management structure is more intricate. Often it is outlined in an LLC operating agreement. The operating agreement details each member's stake in the business, voting rights, and profit share. The LLC can be collectively managed by all the members or an appointed manager.

LLC & Sole Proprietorship Taxation Differences?

If you operate your business as a sole proprietor, you’ll be taxed as a self-employed person, and the income of your business is considered your personal income for tax purposes.

An LLC may make an election to be taxed as a disregarded entity, partnership, corporation, or s-corp. If such an election isn’t made, it’s taxed as either a disregarded entity or a partnership, depending on the number of members it has.

Should You Start an LLC or Sole Proprietorship?

Business owners often start with sole proprietorships. It requires minimal paperwork and is simple in design, as shown previously. Once the business grows, transitioning to an LLC may have the advantage of offering protection against personal liability for bankruptcy.

Those who want personal liability protection, tax benefits, growth potential, credibility, and consumer trust should strongly consider forming an LLC. It is recommended that businesses with more extensive customer bases, increased risk of liability and/ or loss could potentially benefit from unique tax options and have the possibility for immediate sustainable profit. One immediate downside is the fees and more complex formation process than sole proprietorships. However, this can easily be made up for with the benefits your business can assume by establishing your company as an LLC.

Sole proprietorships work well for small-scale, low-risk, and low-profit businesses. Therefore the risk on an owner’s personal assets is minimal. The best business structure will depend on many factors, and it's recommended that you speak to a business lawyer before deciding.

Use the following links to apply for an LLC or to find certain paperwork you may need to run a sole proprietorship in Utah.

LLC:

https://corporations.utah.gov/series-domestic-limited-liability-company/

Sole proprietorship:

https://corporations.utah.gov/business-entities/considerations-in-forming-a-sole-proprietorship/