- Estate Planning

Estate Planning Documents

The ABCs and XYZs of Planning

Estate Planning in Wyoming

Estate planning involves both emotional and financial considerations. Unfortunately, the discomfort many feel when they consider issues relating to death and dying causes many to delay estate planning to avoid facing the difficult questions that arise from it. Others avoid the issue because they believe their estates are too small to matter. Due to these factors, over half of families do not possess even basic Wills.

An estate plan makes everyone's life easier. The person who creates the plan knows their family is taken care of, the family avoids the possibility of fighting, and the government does not become involved. Before selecting an estate planning attorney, a good first step is considering what should be accomplished with the estate plan.

Initiating a discussion about everyone’s interests and preferences helps clarify which actions should be pursued or avoided. A great example of something that should be considered is whether certain property or responsibility should go to certain individuals. These sometimes tough conversations will help to develop a list of critical issues that should be addressed and goals that you would like to accomplish.

Wyoming's legislature has worked hard to draft comprehensive and forward-thinking trust laws. The result is most estate plans in Wyoming are based on Trusts, not Wills.

Estate Planning Considerations

Estate planning is about how we plan for the unexpected. It's not only about planning for death, it's also about planning for disability or incapacity.

Estate planning ensures that our wishes are honored after we pass away or when something unexpected happens. Estate planning will control how your assets are to be distributed to your heirs, but it will make sure that someone you love and trust has the authority to make healthcare decisions on your behalf when you can't make them for yourself.

Without a comprehensive estate plan, when you become incapacitated, the court may have to appoint a conservator or guardian to handle your affairs, which can be extremely stressful for your loved ones and potentially very expensive.

In addition, if you die without a sound estate plan in place, your assets will be distributed by the state's default distribution rules, which will involve probate and may result in your assets being distributed to people you don't want to receive them, by someone you don't trust.

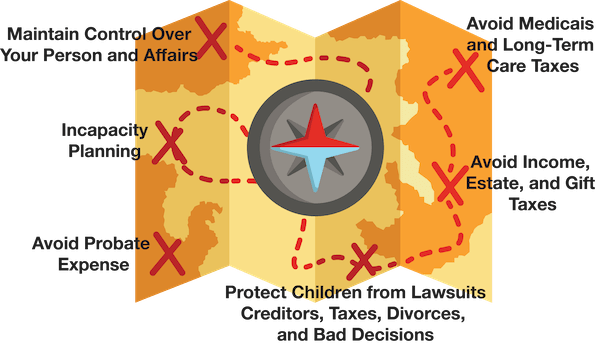

A sound estate plan will allow you to:

- Provide for yourself and your loved ones through a period of disability or incapacity;

- Leave what you want, to who you want, in the way you want;

- Avoid probate and minimize unnecessary fees and court costs; and

- Memorialize your legacy.

Estate Planning Documents

Any sound estate plan will include the following most commonly used estate planning documents:

- Will or Pour Over Will

- Revocable Living Trust

- Advanced Medical Directive

- Durable Financial Power of Attorney

Will or Pour-Over Will

A Will is a legal document that takes effect after you pass away and essentially tells the probate court how you wish your assets to be distributed and appoints someone (your executor or personal representative) to carry out these wishes.

A Pour-Over Will is a simple Will that works in conjunction with a Living Trust. It indicates that you have a Trust and directs any assets that were not transferred into your Trust before you passed away to be transferred into that Trust upon your death.

Any assets that are not transferred to your Trust will be subject to probate. A Pour-Over Will acts as a safety net but is not a substitute for transferring assets into your Trust while you are alive and able.

Living Trust

A Living Trust is a document that contains a set of instructions for how you would like your assets to be managed and distributed after your death, as well as who and what kind of decisions can be made with regard to your assets, finances, and health care when you are alive but incapacitated.

A Living Trust works much like a Will, except it allows you to establish a more comprehensive estate plan wherein you are able to:

- Dictate to whom and how your assets will be distributed;

- Provide for minor children or special needs loved ones; and

- Appoint someone who will step in and manage the trust when you become incapacitated or pass away.

However, perhaps the most important thing about a Living Trust is that it helps avoid probate. Probate is the legal process of finalizing your estate after you die. Probate is a public process that can be both lengthy and expensive and, in most cases, should be avoided if possible.

With a Living Trust, many of your assets are transferred into the Trust during your lifetime and passed directly to your surviving family members without delay or the expense of probate.

Advance Medical Directive

A Medical Directive, also known as an Advance Health Care Directive or Medical Power of Attorney, states your wishes regarding your medical and end-of-life care and appoints an individual to carry out those wishes when you cannot otherwise communicate them yourself.

Durable Financial Power of Attorney

A Financial or General Power of Attorney allows you to authorize someone to manage your finances and property when you are incapacitated.

Summary

To summarize, the most common estate planning documents include a Will or Pour-Over Will, a Living Trust, a Medical Directive, and a Financial Power of Attorney. Whether you are just starting out in life or have accumulated significant assets, having these essential estate planning documents in place will enable you to dictate what happens to those assets when you die or the unexpected happens and to appoint people who you trust to handle your affairs when you are unable to handle them yourself.

Contact an Experienced Wyoming Estate planning Attorney

The laws governing estate planning and probate avoidance vary slightly from state to state. Estate planning strategies vary depending on individual circumstances. For more detailed information about estate planning in Wyoming, consult with an experienced Wyoming estate planning attorney who can advise you on the most effective estate planning options for Wyoming residents.

Estate Planning Services Overview

Have a business to worry about?

Probate is a court-supervised process for transferring assets after you pass away. Probate is usually necessary in Wyoming to transfer assets held by a decedent in his or her sole name at death worth more than $200,000. The process has several drawbacks primarily relating to delays, expenses and privacy. There exist several alternative techniques such as revocable trusts. Learn more about the probate process here.

A Power of Attorney is a legal document which allows someone to act for you. They quit being effective, though, when someone becomes incapacitated. In such cases a Durable Power of Attorney is needed. The Financial planning raises the concern of ensuring effective management of property and financial affairs after you become incapable of managing them. Durable Powers of Attorney provide a flexible and low-cost option for such situations. Lifetime financial planning tackles ensuring effective management of property and financial affairs after you become unable to do so. Important events affecting a person's finances shouldn't be stopped because the person is unconscious or lacks the mental or physical capability of acting on his or her own. See inside for further information on Durable and Medical Power of Attorney forms.

Revocable Trusts are a popular tool and function as the foundation for most estate plans. (Follow here for how Revocable and Irrevocable Trusts differ).

The term "living will" became a household word in 2005 due to events surrounding the acrimonious dispute in Florida over Terri Schiavo. Modern medicine makes such extraordinary situations possible and some may wish to place limits on medical care if they feel the burdens outweigh possible benefits. During such situations establishing a person's wishes is frequently impossible when that person loses the capacity to express themselves. Despite all this, a majority of Americans have failed to provide their family members such guidance. This lack of guidance means family will have an unnecessarily difficult time predicting their loved ones' medical wishes. Completing an Advanced Directive ahead of time helps minimize undue stress during already trying times. Being healthy is no excuse not to begin this important process.

Medicaid planning stems from the understanding end-of-life and long-term health care can be prohibitively expensive for even middle class families. Medicaid is a joint federal-state program which provides means based assistance for those who qualify. Standards differ by state, but generally factor in the income and assets available to pay for medical expenses. There exist strategies for legally making assets inaccessible through the estate planning process. This is generally done via an irrevocable medicaid trust which is a type of Wyoming asset protection trust.

Do you have minor children? If so, then considering planning ahead. Find our guide to choosing and approaching a suitable guardian.

Your LLC is a valuable component of an overall estate plan. State and federal gift and estate tax exemptions are changing, and to keep your plan current an annual estate plan review is advisable. Learn more on our page about Wyoming LLCs. Your LLC contemplates gifts of LLC units to other family members or to trusts that have been established for their benefit. If you did not sign an annual retainer agreement, make sure you contact your attorney and/or CPA to assist you in accomplishing and properly documenting annual gifts. Periodically an appraisal of the assets in your LLC and valuation of the LLC itself is necessary. For gifts to be properly documented, appraisals of assets and valuations of LLC interests must be done at the time gifts are made. Updating must also be done in the event of the death of a member.

Don't Procrastinate On Estate Planing

Elder law is vitally important and we take this responsibility seriously. We have seen the damage caused by ignoring the many nuances and pitfalls that make elder law unique. We cannot sufficiently stress the importance of choosing a competent adviser to protect your interests. Following this vein, we are proud members of the Wyoming Elder Law Counsel. This distinction sets us apart from other elder law attorneys. Elderly law often requires advance planning due to legal waiting periods before tax strategies can be fully implemented.

It is best to deal with the topic sooner, rather than later, so everything is in place when you, a family member, or another loved one passes away. Passing away without a Will can lead to unnecessary anguish and taxes during an already difficult time. You should always consult an attorney when creating your estate plan.