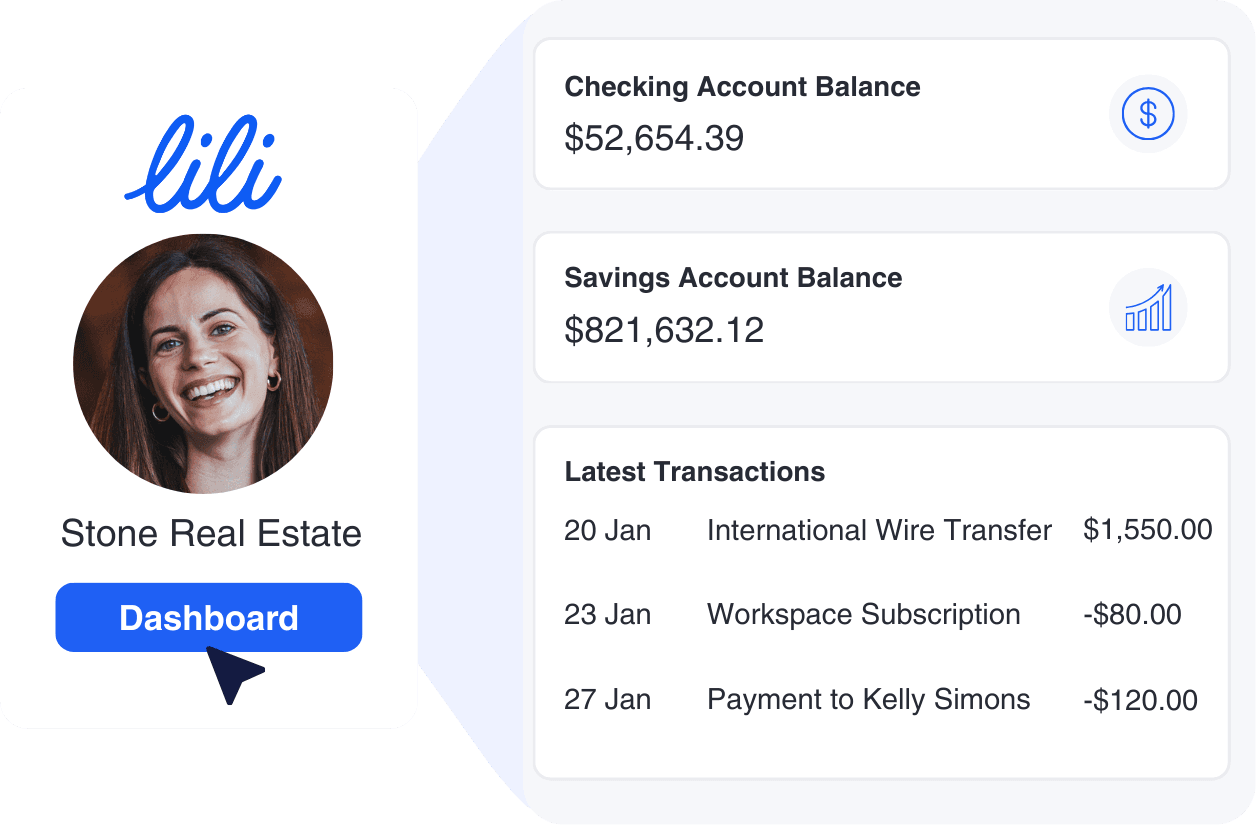

Business Banking with Lili

Meet Lili, our business banking partner available to you through the Wyoming LLC Attorney Business Success Platform™

Lili is a financial technology company, not a bank. Banking services are provided by Sunrise Banks, N.A., Member FDIC.

Banking That Moves At The Speed Of Your Business

In our role as your business concierge, it’s our job to provide you with tools to help you get your business off the ground. That's where our Business Success Platform™ comes in. With our partner Lili, you get an advanced online business banking solution built for growing businesses, with a $0 monthly fee, no hidden charges, up to $3M in FDIC insurance, and the opportunity to earn up to 4% APY on business savings. As your business grows and your needs become more complex, you can upgrade your plan for more tools to support long-term business success.

Why We Chose Lili For You

Lili is built exclusively for SMBs and startups

Entrepreneurs are balancing a million moving parts—running the business, chasing payments and managing cash flow. Lili simplifies that with advanced online business banking for small businesses: fast payments and transfers, checking and savings, higher payment limits, team and accountant access, and dedicated customer support. Built for growing businesses, it gives you the visibility and control to move fast—without hidden fees or surprises.

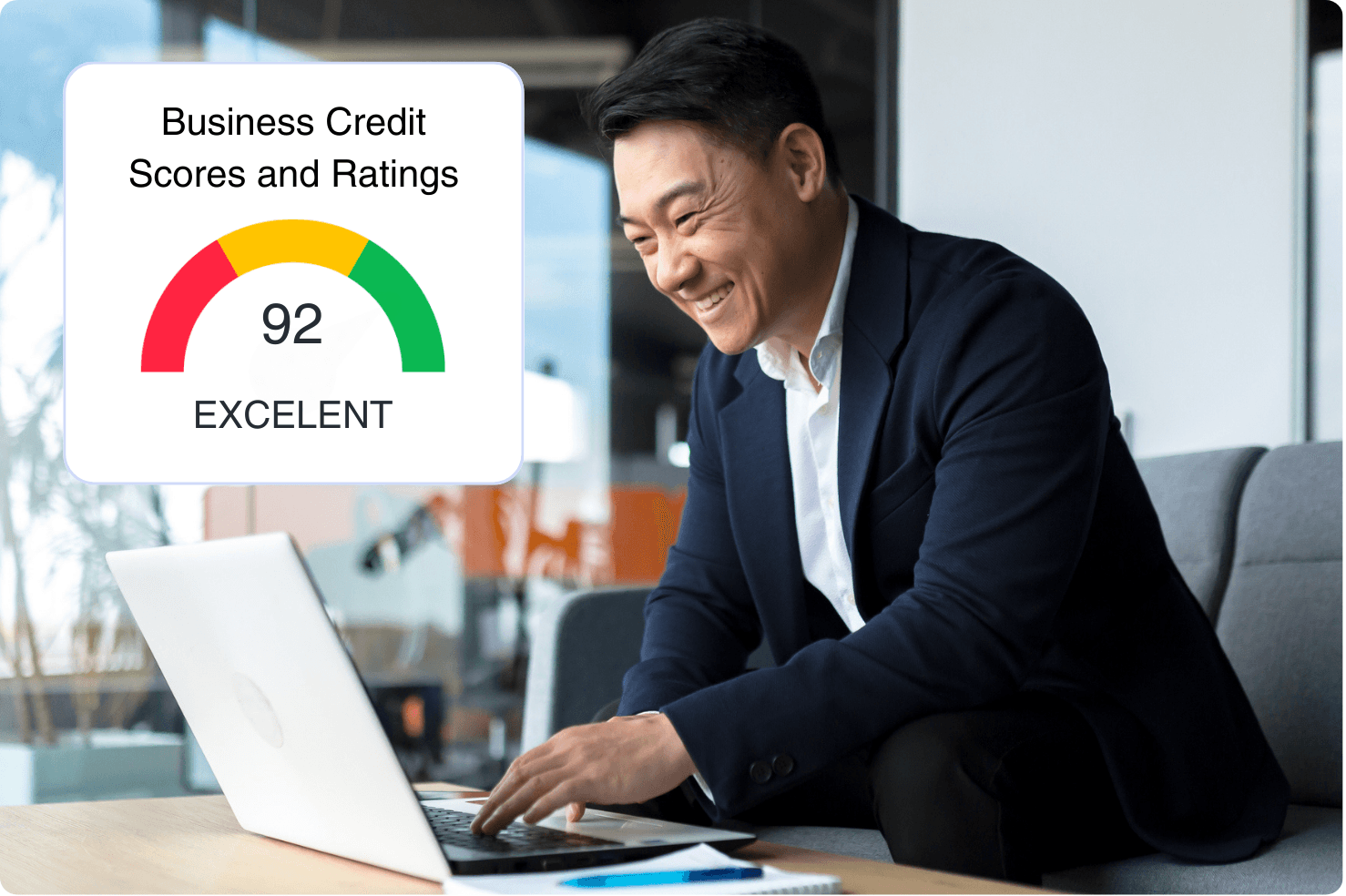

Start with a no monthly fee Account, Upgrade As You Grow

Business owners don’t all need the same tools on day one. Start with Lili Core, an advanced online business banking account with no monthly fee, plus three additional plans that add more tools as your needs become more complex. Plus, unlock BusinessBuild, a credit-building program in collaboration with Dun & Bradstreet that allows you to have 24/7 access to your business credit profile. You will be able to monitor key Dun & Bradstreet credit scores right from your Lili account and receive real-time alerts and insights, making it easier to spot potential risks early and take action when it counts.

Global Banking for International U.S. Founders

For international founders setting up a U.S. business, banking can be one of the biggest headaches. Many traditional banks expect a social security number, in-person visits, or paperwork that's tough to manage from abroad—so you can end up stuck right when you're ready to launch. Lili removes those barriers by letting non-U.S. entrepreneurs open and manage a U.S. business bank account fully online, without being physically in the US. With digital onboarding and remote access from day one, global founders get a trusted U.S. financial partner that makes running a U.S. entity feel actually doable.

Embedded experience with our Business Success Platform™

Our goal is to give customers everything they need to run a business in one place. When you're forming an LLC or corporation, the last thing you want is another random checklist—like hunting down a banking partner you're not sure you can trust. We've already done the research and vetting, so banking is built into the Business Success Platform™. Form your business with us, then apply for a Lili bank account directly inside the platform without jumping elsewhere. You can even integrate your banking dashboard right into your Wyoming LLC Attorney dashboard, keeping every step connected and easy to manage.

What You Get With Lili

Open a Lili business bank account with no monthly fees when you form your LLC or corporation with us (based upon approval). Upgrade options when you’re ready for more advanced business banking features, including a business-credit program and accounting tools.

Features designed specifically for US and non-US based entrepreneurs including:

FDIC insurance up to $3M

Secure large balances through the sweep network.

Earn up to 4.00% on Annual Percentage Yield (APY)

On business savings from the first dollar.

Team and accountant access

Invite your business partners, team, and accountant to access your finances with customized permissions

Invoicing and payments

So you can manage clients and vendors with ease

No foreign transaction fees.

Lili doesn’t charge debit card FX fees.

Virtual and physical debit cards

For your business partners

International wires

Send and receive in 130+ currencies.

Why A Dedicated Business Bank Account Matters

Clear separation of finances

Keeping business and personal funds apart gives you accurate visibility into the health of your business and makes financial decisions more straightforward.

In case of an audit

By keeping your business money independent from your personal money, you can make it clear to the IRS which expenses are which in the case of an audit.

Professionalism + credibility

Having a business checking account sends a signal to everyone you work with that you're professional, you're organized, and you're ready for growth.

Protecting your entity

Mixing personal and business funds can jeopardize your LLC's liability protection. When you open a business account (with Lili through us), you're reinforcing the business entity.

Smarter cash flow management

With Lili's built-in tools, you'll know exactly where your money is going, helping you stay organized and plan more effectively as your business grows.

How Lili and Wyoming LLC Attorney Work Together

You sign up for the free Lili business account via our portal.

Once you're approved, link your account to the Business Success Platform™ so your finances are visible in one dashboard.

As you grow, we'll recommend when to upgrade your Lili plan and how to make the most of your features (international wires, savings yield, team access, and more).

Disclaimers & Compliance:

Lili operates as a financial technology company and is not a bank. Banking services are provided by Sunrise Banks, N.A., Member FDIC. Deposit insurance up to $3,000,000 is available via sweep networks. Some features (including overdraft, APY, credit building, and international wires) vary by plan and eligibility. Terms and availability are subject to change; see Lili for the latest information.

Ready To Get Started?

Form your company with Wyoming LLC Attorney, then manage your finances with Lili's SMB business banking platform.